Hanoi (VNS/VNA) - As the country’s consumption demand increases to match national economic progress, more and more foreign retailers are entering the Vietnamese market to a warm welcome from buyers, while Vietnam’s domestic brands look for their own growth strategies against the newcomers.

Regarding the rising trend of foreign firms gaining market share in Vietnam, reports from the Ministry of Industry and Trade (MoIT) stated that at the moment, there are roughly a thousand convenience stores across the entire country, plus a few hundred supermarkets and shopping centres. These figures are considered too little for a population of 90 million and demand rising everyday.

This is even more disconcerting when put into perspective, as there is approximately one convenience store per 69,000 Vietnamese citizens, compared to one per 21,000 in China and one per 1,800 in the Republic of Korea as at the end of 2016.

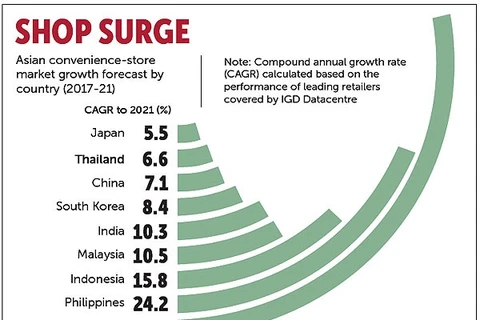

Le Viet Nga, deputy head of MoIT’s Domestic Market Department, stated that convenience stores had received a good reception in the market, and were on their way to becoming the fastest growing retail segment, with double digit growth in 2017.

‘Convenience stores are the new and modern trading channel, selling products with clear origins and offering good customer service. As such, they allow small- and medium-sized enterprises many opportunities to approach buyers in a direct manner,” said Nga.

According to the MoIT, investors are also favouring convenience stores since their return on investment is much higher than traditional supermarkets or hypermarkets, while initial investment is much lower.

Furthermore, business licences for convenience stores and mini-marketplaces are easier to obtain than for supermarkets, since retail outlets of less than 500sq.m are not subject to the economic needs test (ENT), Nga commented.

As such, foreign entities are quick to sniff out potential customers and can easily infiltrate the Vietnamese market thanks to their advantages in terms of capital, business strategy and an established global distribution chain.

Furthermore, as Vietnam is full of fresh products available year round at relatively cheap prices and populated residential areas, convenience stores can easily meet demand by supplying consumers with a variety of products at small neighbourhood outlets.

Recently, well known names such as the Philippines’ Shop&Go, US’ Circle K and Japan’s 7-Eleven have approached Vietnamese consumers with great success. Their strengths lie in convenience, in terms of both time and location, first and foremost, followed by affordable prices and a customer-friendly environment.

[Video: Vietnam among top six most attractive retail markets]

Other stores specialising in household items and fashion accessories that have populated Vietnam’s retail market include China’s Miniso and Ilahui since late 2016, and Daiso since 2008. The explosion of such brands has steered consumers towards the rising convenience store trend.

In less than a year, more than 100 such convenience stores have opened in Hanoi, HCM City, and other major cities in Vietnam, with some even reaching out to more remote areas. The model caters to lower- and middle-class shoppers with a variety of convenient and affordable goods.

The MoIT reports that more than 70 percent of convenience stores on the market, as well as 17 percent of malls and supermarkets, 15 percent of mini-marketplaces and 50 percent of online shopping channels belong to foreign companies.

Indigenous forte

Despite the crowded sector, domestic brands such as VinGroup and Saigon Co.op are gaining market share, though there is a dearth of other notable names.

VinGroups’s retail section, VinCommerce, was crowned the fastest growing retailer in Vietnam in 2016. The company’s retail network now has a store count of over 930, including a variety of Vinmart supermarkets, Vinmart convenience stores, Vinpro electronics stores, and VinDS consumer lifestyle specialty stores, all over the country.

Additionally, Saigon Co.op General Director Nguyen Thanh Nhan said that his company was looking to increase the number of Co.op Smile stores to 300 by the end of 2017, compared to the mere 20 outlets in 2016.

Traditional retail channels still account for 72 percent of the market but this number is forecasted to decline to just 60 percent in 2020, as stated in reports by the MoIT.

Speaking on this matter, L. Chaitanya Kishore Reddy, Research Director and Representative of TNS Vietnam, advised Vietnamese producers and distributors to focus on supplying buyers with the values that they need, which at the moment is convenience and efficiency.

Reddy also said that the Vietnamese Government must help enhance the distribution chain from input to output, especially with smaller producers, and encourage larger businesses to unify small- and medium-sized distributors within the national retail value chain.-VNA

VNA