Hanoi (VNA) - The Vietnam Asset Management Company has decided to hike its reference interest rate on bad debts to 9.9 percent from the fourth quarter, up from 9.7 percent.

The rate is calculated based on the average deposit interest rates at the four State-owned joint stock banks, Agribank, BIDV, VietinBank and Vietcombank.

The reference rate determines the pay-offs in a financial contract.

The average interest rate of the banking sector’s four biggest players has shown signs of increasing in recent times.

Vietinbank has the highest deposit interest rates and shows clear signs of hiking the rates.

Since the beginning of this year its deposits interest rates have risen by 0.2-0.5 percentage points to 4.8-6 percent.

Other banks too have begun to hike deposit interest rates starting late last month.

VPBank, for instance, increased its rates by 0.2 percentage points for six- to 11-month terms to 6.3-6.5 percent. Techcombank’s rates for deposits of four to six months are up 0.2-0.3 percentage points to 5.3-5.7 percent.

Normally, banks hike interest rates in the last few months of the year when demand for credit often increases ahead of the peak shopping season, and has a knock-on effect on deposit rates.

But the hikes were not expected to happen this year because the State Bank of Vietnam had made great efforts to keep them steady by keeping its interest rates lower and improving banks’ liquidity. But its efforts are seemingly in vain.

The central bank recently announced several policies following the Government’s demand to cut interest rates.

In July it cut several key benchmark rates such as refinance rates, discount rates, the rate on overnight loans, and lending rates for priority sectors.

It also bought foreign exchange to improve its reserves, which helped improve banks’ VND liquidity.

The central bank’s moves have partly contributed to reducing the interest rates on the bond and inter-bank markets. But they did not affect the deposit interest rates.

Analysts have expressed concern that the hikes in deposit interest rates will make it difficult to achieve the Government’s plan to further cut lending interest rates by 0.5 percent to support enterprises.

Many analysts attributed the hikes in deposit interest rates to the rising inflation rate and credit demand.

They said individuals often decide to deposit in banks based on the inflation rate.

In the first seven months of the year prices were quite steady, sometimes even declining. But in recent months they have been trending upward, rising to 3.9 percent, almost reaching the full-year inflation target of 4 percent.

In August the prices of 10 out of 11 groups of commodities increased compared to July. Drugs and health services registered the highest increase of 2.86 percent. Transport was up by 2.13 percent, food and catering services by 1.06 percent, housing and construction materials by 0.93 percent, and education by 0.57 percent.

The General Statistics Office has predicted that fuel prices will continue to rise until year-end, affecting the prices of several essential goods.

In its recently updated ”Asia prospect” report, the Asian Development Bank (ADB) adjusted its forecast for Vietnam’s average inflation rates to 4.5 percent this year and 5 percent next year.

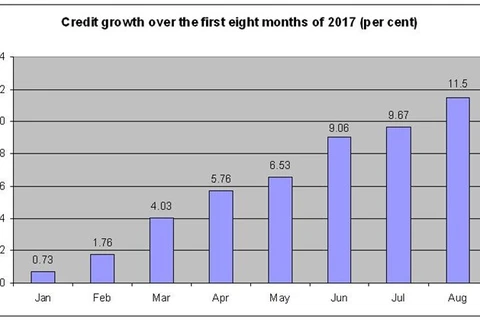

The Government’s recent loosening of credit policy to hike the credit growth target to over 20 percent from the earlier 18 percent is another important reason for the increase in inflation.

The increase in the deposit interest rates also is due to the pressure from the foreign exchange market.

The demand for foreign exchange, particularly from import firms, often increases at the year-end ahead of the peak shopping and festival seasons. This pushes up the value of the greenback against the VND. To hold on to their deposits, banks then have to hike interest rates on VND deposits.-VND

The rate is calculated based on the average deposit interest rates at the four State-owned joint stock banks, Agribank, BIDV, VietinBank and Vietcombank.

The reference rate determines the pay-offs in a financial contract.

The average interest rate of the banking sector’s four biggest players has shown signs of increasing in recent times.

Vietinbank has the highest deposit interest rates and shows clear signs of hiking the rates.

Since the beginning of this year its deposits interest rates have risen by 0.2-0.5 percentage points to 4.8-6 percent.

Other banks too have begun to hike deposit interest rates starting late last month.

VPBank, for instance, increased its rates by 0.2 percentage points for six- to 11-month terms to 6.3-6.5 percent. Techcombank’s rates for deposits of four to six months are up 0.2-0.3 percentage points to 5.3-5.7 percent.

Normally, banks hike interest rates in the last few months of the year when demand for credit often increases ahead of the peak shopping season, and has a knock-on effect on deposit rates.

But the hikes were not expected to happen this year because the State Bank of Vietnam had made great efforts to keep them steady by keeping its interest rates lower and improving banks’ liquidity. But its efforts are seemingly in vain.

The central bank recently announced several policies following the Government’s demand to cut interest rates.

In July it cut several key benchmark rates such as refinance rates, discount rates, the rate on overnight loans, and lending rates for priority sectors.

It also bought foreign exchange to improve its reserves, which helped improve banks’ VND liquidity.

The central bank’s moves have partly contributed to reducing the interest rates on the bond and inter-bank markets. But they did not affect the deposit interest rates.

Analysts have expressed concern that the hikes in deposit interest rates will make it difficult to achieve the Government’s plan to further cut lending interest rates by 0.5 percent to support enterprises.

Many analysts attributed the hikes in deposit interest rates to the rising inflation rate and credit demand.

They said individuals often decide to deposit in banks based on the inflation rate.

In the first seven months of the year prices were quite steady, sometimes even declining. But in recent months they have been trending upward, rising to 3.9 percent, almost reaching the full-year inflation target of 4 percent.

In August the prices of 10 out of 11 groups of commodities increased compared to July. Drugs and health services registered the highest increase of 2.86 percent. Transport was up by 2.13 percent, food and catering services by 1.06 percent, housing and construction materials by 0.93 percent, and education by 0.57 percent.

The General Statistics Office has predicted that fuel prices will continue to rise until year-end, affecting the prices of several essential goods.

In its recently updated ”Asia prospect” report, the Asian Development Bank (ADB) adjusted its forecast for Vietnam’s average inflation rates to 4.5 percent this year and 5 percent next year.

The Government’s recent loosening of credit policy to hike the credit growth target to over 20 percent from the earlier 18 percent is another important reason for the increase in inflation.

The increase in the deposit interest rates also is due to the pressure from the foreign exchange market.

The demand for foreign exchange, particularly from import firms, often increases at the year-end ahead of the peak shopping and festival seasons. This pushes up the value of the greenback against the VND. To hold on to their deposits, banks then have to hike interest rates on VND deposits.-VND

VNA