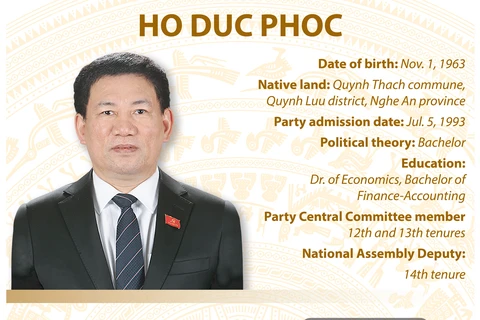

Nhập môMinister of Finance Ho Duc Phoc speaks at the National Assembly’s working session. (Photo: VNA)

Nhập môMinister of Finance Ho Duc Phoc speaks at the National Assembly’s working session. (Photo: VNA) Hanoi (VNA) - Minister of Finance Ho Duc Phoc cleared up legislators’ concerns over the implementation of the 2021 socio-economic development plan and the draft plan for 2022 at a working session of the 15th National Assembly’s second sitting on November 9.

He said the Government has devised incentives and stimulus packages to spur economic development and production amid impacts of the COVID-19 pandemic.

Not much room left for public debts

It can be said that the task of budget collection for 2021 has been basically completed, even surpassing the estimate, Phoc said, adding that budget spending matches the estimate while budget overspending is kept within 4 percent of the gross domestic product (GDP) as set by the National Assembly.

Notably, the Government has issued a number of fiscal policies to support businesses and people, as well as the pandemic fight, with total funding of 200 trillion VND.

Under Decree No. 52/ND-CP, the Government has offered tax payment extension and tax reduction to businesses, worth 115 trillion VND.

Meanwhile, tax reduction worth 21.3 trillion VND has been created under Decree No. 92/ND-CP. More than 9 trillion VND has been channeled into the vaccine fund.

The minister noticed that there is not much room left for public debts. During the 2016-2020 period, the Government’s total debts reached 1.85 quadrillion VND. Between 2021 and 2025, the figure is set at 3.06 quadrillion VND, 1.77 times as compared with the previous period.

Phoc said the finance ministry supports the Government’s stimulus packages to boost economic development and production, noting that the ministry has advised the Government on the stimulus packages worth 40 trillion VND for two years.

The stimulus packages are expected to inject 1 quadrillion VND (44 billion USD) into the national economy with an interest-rate subsidy of 4 percent, contributing to creating jobs, raising productivity, increasing budget collection, and cutting budget overspending.

Supporting those with no bad debts

Responding to proposals on preferential policies towards industrial parks, the minister said Vietnam counts 18 economic zones and 377 industrial parks. The Government has offered a 10 percent preferential tax rate within 15 years, tax exemption for four years, and 5 percent tax reduction for the next nine years, along with other policies.

For legislators’ opinions on increasing crude oil estimates, Phoc said it is impossible to raise the estimate as the actual output during the 2016-2021 period dropped about 1.45 million tonnes each year (or 11 percent).

Regarding tax imposition on fertilizers, he said the NA Standing Committee has assigned the Ministry of Finance to give consultancy to the Government in perfecting the Tax Law as fertilizers are now subjected to zero percent tax, which only benefits foreign firms.

The minister also talked about interest rate subsidies, saying the Government will only target those that can create value for the national economy, especially those having no bad debts.

At the working session, some deputies expressed their concern that the 2022 budget collection would fulfill only 3.4 percent of the set target.

In response, Phoc said during unexpected periods, budget collection is not in proportion to GDP growth, and the finance ministry had working sessions on this issue with ministries, agencies and localities.

In fact, during 2011-2012 when the national economy grew by 5.12 percent, budget collection hit just 2.2 percent. Meanwhile, in 2020 when the GDP rose 2.91 percent, the budget collection rate was only 1.6 percent, he further explained./.