A business report in the first quarter of 2020 analysing industrial parks listed on the Vietnam stock market showed that the total revenue of the industry group reached 7,804 billion VND, an increase of 0.9% over the same period in 2019. However, after-tax profit only reached 1,100 billion VND and decreased by 19.5% over the same period.

Enterprises that enjoyed strong growth were codes SZC, D2D, MH3, NTC, and SNZ. Meanwhile, codes that recorded a fall included SIP, BCM, BAX, IDC.

Prospect from enterprises which have property available

According to an analysis report from SSI Securities Company, industrial zone enterprises’ business plans in 2020 are cautious due to concerns regarding slow foreign direct investment promotions from investors that have been impacted by the COVID-19 pandemic, and a lack of availability in new leasing areas in industrial zones with good infrastructure due to slow licensing procedures and difficulties in compensation and clearance.

Hoang Viet Phuong, Director of the Centre for Analysis and Investment Advisory said listed industrial parks are divided into 3 groups. IPs that have land for lease, industrial parks which have been occupied with no available space for lease and industrial parks which have expanding plans.

Signal to thrive

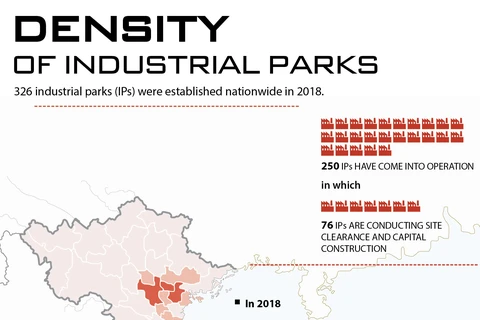

However, the first quarter report from the Department of Economic Zones Management under the Ministry of Planning and Investment shows that Vietnam has 335 industrial zones, of which 260 have a total area of 68,700 hectares in operation and 75 industrial parks, which are under construction and have a total area of 29,200 ha. Currently, the occupancy rate is 75%, and increases by 0.7% compared to the end of 2019.

The first quarter report of the Collier International Company revealed that the occupancy ratio and leasing price in industrial parks in ASEAN countries showed Vietnam as an attractive market, with an average leasing price 50 percent cheaper compared to countries such as Thailand, Malaysia, and Indonesia.

A report from Jetro in 2019 showed that labour cost in Vietnam was cheaper compared to Thailand, Malaysia and Indonesia.

SSI's analysis group also acknowledged that the inflow of foreign investment (FDI) into the industrial zone had shown an upward trend. Specifically, the total newly registered capital and additional capital in the first five months of 2020 reached 13.9 billion USD. In addition, COVID-19 pandemic has also created new opportunities for international foreign direct investment, with the aim of minimising the breakdown in the supply chain, which will urgently increase the need to diversify production, avoiding big dependence on one single country, with the shift of production from China to other countries occurring more rapidly.

Phuong acknowledged: “Big names such as Pegatron, Amazon and Home Depot have started their recruitment, and they’re looking for supply chains. Vietnam has become one of attractive destination in the transition process among other potential countries in the region such as Indonesia, Thailand and Myanmar”.

Domestically, the Government has continued to promote public investment with the goal of strong growth in 2020, reaching 20 billion USD. Thus, the total scale of disbursement expected in 2020 is very large, approximately 30 billion USD, particularly for big projects such as the North-South expressway, Bien Hoa-Vung Tau expressway, Dau Giay and Phan Thiet expressway, helping to connect infrastructure, logistics of industrial zones in satellite provinces of Ba Ria Vung Tau and Phan Thiet to the centre of Ho Chi Minh City, Dong Nai and Binh Duong.

According to Phuong, it is an advantage to increase Vietnam’s competitiveness in order to lure foreign direct investment compared to other countries in the region./.