HCM City (VNS/VNA) - The UK-Vietnam Free Trade Agreement (UKVFTA) has had a significant impact on Vietnam’s export-oriented industries, driving growth and opening up new opportunities for both countries, experts have said.

According to a report by the Ministry of Industry and Trade, trade between Vietnam and the UK reached 6.8 billion USD in 2022, up 3.3% year-on-year.

Vietnam’s exports to the UK played a major role in the achievement with goods like textiles, electronics, and agricultural products highly appreciated for their quality and affordability by UK consumers.

On the other hand, Vietnam’s imports from the UK slightly declined as Vietnam focused on developing its own domestic industries and reducing reliance on imported goods.

The trade pact has opened up multiple opportunities for both UK and Vietnamese companies.

UK firms are actively seeking partnerships and investment opportunities in the Vietnamese market. Vietnamese companies, on the other hand, have gained greater access to the UK market, introducing more locally made products to UK consumers.

The UK is known for its diverse import requirements and high consumer purchasing power.

Vietnamese enterprises will have an opportunity to gain access to this market under preferential and competitive conditions, with nearly 100% of Vietnamese goods exported to the UK being exempt from import tax after six years.

The commitments made in the UKVFTA will enable businesses to access new sources of raw materials and reduce dependence on traditional import markets, enhancing Vietnam’s participation in regional and global supply chains.

The UKVFTA also helps create a more favourable environment for British companies to invest in Vietnam, which will result in increased FDI inflows, technology transfer, and knowledge sharing.

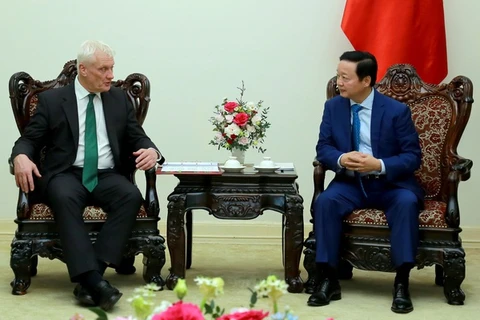

Speaking at a recent meeting in Hanoi, Prime Minister Pham Minh Chinh said Vietnam would create the most favourable conditions for British investors to expand trade and investment in the country.

The trade deal has helped not only to boost bilateral trade between Vietnam and the UK but also swing the door wide open for the investment of UK companies in Vietnam, he said.

The PM proposed that both nations continue taking advantage of preferences from the trade deal to improve bilateral economic, trade, and investment cooperation.

He called on UK investors to invest in Vietnam’s many sectors such as green growth, digital transformation, start-ups and innovation, education and training, and pharmaceutical manufacturing.

As of December 2022, the UK has invested in a total of 507 projects in Vietnam, with a total investment of nearly 4.2 billion USD, ranking 15th out of 141 countries and territories investing in Vietnam.

In 2022 alone, the UK invested in 53 new investment projects in Vietnam, with a registered capital of 64.33 million USD.

Challenges

Despite the opportunities presented by the UKVFTA, experts have warned that local firms will face tough competition from foreign rivals.

The removal of trade barriers and tariff reductions will make it easier for UK companies to enter the Vietnamese market and compete directly with domestic firms.

Vietnamese firms may face challenges in understanding the rules and regulations of the UK market, including customs procedures, documentation requirements, and compliance with trade rules.

Local firms, especially small and medium-sized enterprises (SMEs), may lack the financial and logistical capabilities to expand their exports to the UK market.

Apart from tariffs, non-tariff barriers such as technical barriers to trade, intellectual property rights, and sanitary and phytosanitary measures can pose challenges for Vietnamese firms.

Complying with these requirements and regulations can be time-consuming and costly.

Local enterprises will need to focus on enhancing their productivity and efficiency, improving their product quality and branding, and seeking ways to innovate in order to remain competitive.

The Government can also play a crucial role by providing support and incentives to local businesses, helping them to adapt to the increased competition and take advantage of the opportunities presented by the free trade agreement.

The UKVFTA, which took effect early 2021, eliminates tariffs on 99% of all goods traded between the UK and Vietnam over the long term, providing a significant advantage to Vietnamese exporters.

The trade pact allows Vietnam to diversify its export destinations and reduce its reliance on a few key markets.

The agreement also includes provisions to simplify customs procedures and reduce bureaucratic barriers, making it easier for Vietnamese exporters to access the UK market.

The trade deal also covers services and investment, allowing Vietnamese service providers to access the UK market through improved market access and regulatory transparency.

The agreement is expected to have a significant impact on the growth and competitiveness of Vietnam’s export-oriented industries across various sectors such as textiles and garments, electronics and electrical equipment, agricultural and seafood products, automobiles and automobile parts, and others.

Vietnamese firms operating in sectors such as finance, telecommunications, tourism, and education can also benefit from improved access to the UK’s service market./.

According to a report by the Ministry of Industry and Trade, trade between Vietnam and the UK reached 6.8 billion USD in 2022, up 3.3% year-on-year.

Vietnam’s exports to the UK played a major role in the achievement with goods like textiles, electronics, and agricultural products highly appreciated for their quality and affordability by UK consumers.

On the other hand, Vietnam’s imports from the UK slightly declined as Vietnam focused on developing its own domestic industries and reducing reliance on imported goods.

The trade pact has opened up multiple opportunities for both UK and Vietnamese companies.

UK firms are actively seeking partnerships and investment opportunities in the Vietnamese market. Vietnamese companies, on the other hand, have gained greater access to the UK market, introducing more locally made products to UK consumers.

The UK is known for its diverse import requirements and high consumer purchasing power.

Vietnamese enterprises will have an opportunity to gain access to this market under preferential and competitive conditions, with nearly 100% of Vietnamese goods exported to the UK being exempt from import tax after six years.

The commitments made in the UKVFTA will enable businesses to access new sources of raw materials and reduce dependence on traditional import markets, enhancing Vietnam’s participation in regional and global supply chains.

The UKVFTA also helps create a more favourable environment for British companies to invest in Vietnam, which will result in increased FDI inflows, technology transfer, and knowledge sharing.

Speaking at a recent meeting in Hanoi, Prime Minister Pham Minh Chinh said Vietnam would create the most favourable conditions for British investors to expand trade and investment in the country.

The trade deal has helped not only to boost bilateral trade between Vietnam and the UK but also swing the door wide open for the investment of UK companies in Vietnam, he said.

The PM proposed that both nations continue taking advantage of preferences from the trade deal to improve bilateral economic, trade, and investment cooperation.

He called on UK investors to invest in Vietnam’s many sectors such as green growth, digital transformation, start-ups and innovation, education and training, and pharmaceutical manufacturing.

As of December 2022, the UK has invested in a total of 507 projects in Vietnam, with a total investment of nearly 4.2 billion USD, ranking 15th out of 141 countries and territories investing in Vietnam.

In 2022 alone, the UK invested in 53 new investment projects in Vietnam, with a registered capital of 64.33 million USD.

Challenges

Despite the opportunities presented by the UKVFTA, experts have warned that local firms will face tough competition from foreign rivals.

The removal of trade barriers and tariff reductions will make it easier for UK companies to enter the Vietnamese market and compete directly with domestic firms.

Vietnamese firms may face challenges in understanding the rules and regulations of the UK market, including customs procedures, documentation requirements, and compliance with trade rules.

Local firms, especially small and medium-sized enterprises (SMEs), may lack the financial and logistical capabilities to expand their exports to the UK market.

Apart from tariffs, non-tariff barriers such as technical barriers to trade, intellectual property rights, and sanitary and phytosanitary measures can pose challenges for Vietnamese firms.

Complying with these requirements and regulations can be time-consuming and costly.

Local enterprises will need to focus on enhancing their productivity and efficiency, improving their product quality and branding, and seeking ways to innovate in order to remain competitive.

The Government can also play a crucial role by providing support and incentives to local businesses, helping them to adapt to the increased competition and take advantage of the opportunities presented by the free trade agreement.

The UKVFTA, which took effect early 2021, eliminates tariffs on 99% of all goods traded between the UK and Vietnam over the long term, providing a significant advantage to Vietnamese exporters.

The trade pact allows Vietnam to diversify its export destinations and reduce its reliance on a few key markets.

The agreement also includes provisions to simplify customs procedures and reduce bureaucratic barriers, making it easier for Vietnamese exporters to access the UK market.

The trade deal also covers services and investment, allowing Vietnamese service providers to access the UK market through improved market access and regulatory transparency.

The agreement is expected to have a significant impact on the growth and competitiveness of Vietnam’s export-oriented industries across various sectors such as textiles and garments, electronics and electrical equipment, agricultural and seafood products, automobiles and automobile parts, and others.

Vietnamese firms operating in sectors such as finance, telecommunications, tourism, and education can also benefit from improved access to the UK’s service market./.

VNA