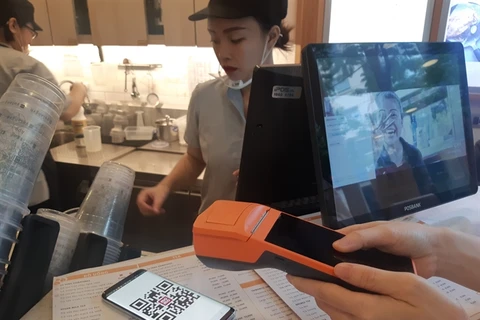

The popularity of contactless payments rockets in Vietnam, with banks launching more options for customers to enjoy going cashless. (Photo: vtv.vn)

The popularity of contactless payments rockets in Vietnam, with banks launching more options for customers to enjoy going cashless. (Photo: vtv.vn)Hanoi (VNA) - The popularity of contactless payments has rocketed in Vietnam over the last few years, with banks launching more options for customers to enjoy going cashless.

Contactless payments are a new technology that allow users to simply tap their card, smartphone, or wearable device against a POS terminal to pay, rather than swipe or insert a card.

They are gaining in favour among shoppers in Vietnam because they are a faster, more secure, and more convenient way to pay. The COVID-19 pandemic also appears to have further encouraged people to adopt contactless payments due to increasing concerns about hygiene and social distancing measures.

Data from the State Bank of Vietnam (SBV) shows that the number of domestic banking transactions grew 26.2 percent in the first four months of this year, with value rising 15.7 percent. Mobile payments increased sharply by 189 percent in number and 166 percent in value from a year earlier.

The latest Visa Consumer Payment Attitudes study found that 37 percent of respondents were using contactless payment cards, 42 percent of them made mobile contactless payments.

Of those already using contactless payment methods, 85 percent are doing so at least once a week, the study found.

It also revealed that four out of five consumers who have not used contactless payments are interested in doing so. More than 80 percent expressed an interest in biometric authentication technology, which uses fingerprints or facial or voice recognition to authenticate payments.

More domestic banks have converted their cards into contactless smart cards, such as Techcombank, BIDV, Vietcombank, Kienlongbank and TPBank, among others.

“Cashless transactions benefit both businesses and customers, and these benefits go both ways,” said Dang Tuyet Dung, Visa Country Manager for Vietnam and Laos. “When customers have a better experience, merchants will benefit from increased transactions and shopper loyalty, and when merchants are operating more efficiently and effectively, they can better serve customers.”

“It really is a win-win proposition,” she noted.

TPBank, Vietinbank, and Sacombank allow cash withdrawals using a QR Code at their ATMs, while customers can scan their fingerprints to receive cash at either the ATMs or transaction offices of Eximbank and VietBank without a debit card, an ID card, or a passport.

These technologies make money transfers, cash withdrawals, and payments easier and more secure as they reduce the possibility of card loss, card theft, or data theft, according to Dr Nguyen Tri Hieu, a banking and financial specialist.

When fintech firms began to appear a few years ago, banks viewed them as competitors, Chief Information Officer (CIO) at VietCapitalBank Phan Viet Hai said. Now, they view them as partners to together provide more convenient services for customers.

VietCapitalBank has worked with popular e-wallets such as ZaloPay and AirPay to enable its card holders to make cashless payments at convenience stores like 7-Eleven, Circle K, and others.

Hai also noted that the greatest challenges to the sustainable development of e-wallets and Mobile Money remain in identity verification and security.

Banks must abide by SBV and international rules regarding identity verification to prevent money laundering and protect users’ assets, he said, emphasising the need for a legal framework on identity verification and transaction safety and security./.

VNA