Hanoi (VNS/VNA) - Vietnam has big potential in applying 4.0 technology to develop retail banks and payment utilities.

The Industry 4.0 trend involves a wave of digitalisation, changing the business models and activities of many banks.

Nguyen Dinh Tung, General Director of Orient Commercial Bank (OCB), said the participation of digital banks would be helpful for domestic and international enterprises when doing business and investing in Vietnam.

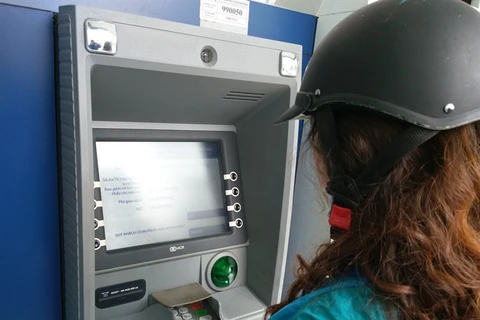

Banking transactions could become quick and easy and could be done anywhere without needing to visit traditional branches, Tùng told Thoi bao Kinh te Viet Nam (Vietnam Economic Times).

Investment in digital technology by Vietnamese banks would be a revolution for all customers, he added.

The Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) was recently awarded SWIFT’s Global Payment Innovation Initiative (GPI) certificate.

Dao Minh Tuan, Deputy General Director of Vietcombank, said by becoming a GPI bank, Vietcombank was ready to provide comprehensive solutions which could meet the demands of customers in money transfer activities by boosting the process, increasing its transparency and status checking ability.

The bank would continue to implement new utilities to improve the processing speed of transactions in the future, he said.

Shinhan Bank is also implementing digital banking to provide more non-cash payment channels to Vietnamese customers.

Shinhan’s ATM cardholders can conveniently withdraw money using Samsung Pay at ATMs without cards.

With the orientation of becoming a leading retail bank in Vietnam, the Sai Gon – Hanoi Bank (SHB) has implemented key systems for information and technology (IT) activities.

SHB this year has been continuing to implement a series of new solutions on modern technology platforms such as centralised data storage systems, smart governance, data analysis applying big data and Artificial Intelligence (AI) in order to enhance data analysis capacities and serve business development.

VietABank is boosting investment in IT systems to develop a digital banking strategy as part of the fourth industrial revolution. Recently, the bank introduced products applying AI such as Smart Branch and ChatBot.

Nguyen Xuan Vu, a member of the management board at Sai Gon Thuong Tin Commercial Joint Stock Bank (Sacombank), said by using modern IT platforms, Sacombank has the opportunity to develop digital banking, introduce convenient products and services, quick payment solutions, while increasing security.

Internet banking and mobile banking systems by Sacombank have been upgraded to the Omnichannel platform, enabling electronic transaction channels of the bank to keep pace with IT trends around the world, he said.

The bank would continue researching and boosting co-operation with partners to create more products suitable with markets and meet non-cash transaction demands of customers, he said.

Do Minh Phu, TPBank’s management council chairman, told the newspaper that the bank had prepared platforms as part of a 2018-2023 plan with the goal of becoming one of the top ten banks which have developed sustainably and strived to keep the top position in digital banking development. - VNA

VNA