Hanoi (VNA) – The Vietnam Social Security has directed its branches in cities and provinces nationwide to collect compulsory social insurance premiums of foreign employees in the country.

Under the Government’s Decree No.143/2018/ND-CP, which took effect from December 1, 2018, employees who are foreign citizens working in Vietnam with either a work permit, practice certificate, or practice licence granted by Vietnamese authorities and under unfixed-term labour contracts or contracts with a term of full one year and above will be covered by compulsory social insurance.

Similar to Vietnamese employees, the social insurance scheme for foreigners will cover sickness, maternity, occupational diseases and accidents, retirement, and survivor benefits.

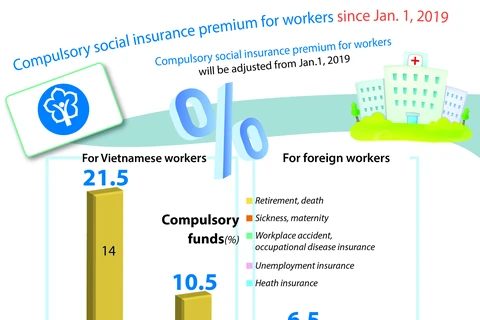

From January 1, 2022, foreign labourers who are subject to the compulsory insurance scheme must contribute 8 percent of their monthly salary to the retirement and survivor benefit fund, equivalent to the amount their Vietnamese peers do.

Meanwhile, it is compulsory for employers to contribute amounts equal to 3 percent of the employees’ monthly salary to the sickness and maternity funds, and 0.5 percent to the funds for occupational accidents and hazards. They also have to contribute 14 percent of the employees’ monthly salary to the retirement and survivor benefit funds.

According to statistics by the Ministry of Labour, Invalids, and Social Affairs, the number of foreign employees in the country increased from 63,557 in 2011 to 83,046 in 2016. They mostly came from Asian countries like China, the Republic of Korea, and Japan, accounting for 73 percent of the total; followed by European nations (21.6 percent) and North America (2.4 percent). –VNA

VNA