Gold becomes hot investment channel as central banks deliver more rate

Hanoi (VNA) – With ultra-loose monetary policy worldwide, nominal interest rates of 95 central banks have been cut 38 percentage points from the outset of the year, and gold has become the most profitable investment channel.

Increasing trade tensions between the US and China has made the global financial market volatile.

In August, the market had an abundant supply of the Vietnamese dong due to the State Bank of Vietnam (SBV)’s injection of 68.4 trillion VND (USD) in the open market and purchases of foreign currencies. Therefore, the overnight inter-bank interest rate hovered around 3 percent per year.

Interest rates higher in the end of month

Although more than 31 trillion VND was pumped into the market in the last week of the month, the inter-bank rates jumped to 4.35 percent on the spur of the moment.

Chief Economist cum R&D Director at SSI Securities Corporation Nguyen Duc Hung Linh attributed the situation to growing demand for the Vietnamese dong before National Day (September 2). In addition, the central bank’s reserve requirement ratio in the context that commercial joint stock banks cut supply made the inter-bank rates on strong surge.

“This is only a short-lived fluctuation, the interest rates will soon fall to 3.5 percent per year, and the difference between interest rates of VND and USD will maintain at 1.4 percent per year”, he said.

Deposit rates have heated up in recent weeks. Commercial banks hiked interest rates to 8-8.5 percent for the 12-month deposits, and more than 9 percent for deposits from 24-month term.

Statistics from the SBV showed that, credit growth expanded 7.36 percent in the first six months of the year, and other services enjoyed strongest growth of 9.07 percent. Deposit rates will vary enormously in the time ahead, depending on ratio of short-term funds for medium- and long-term loans, credit structure of each bank, and wider gap among banks for deposits with the same terms.

Gold has become the most profitable investment channel in both domestic and international markets. (Photo: VNA)

Gold has become the most profitable investment channel in both domestic and international markets. (Photo: VNA)

China’ Yuan falls to lowest level in 25 years

The US – China trade war has escalated after a month of cooling down. It restarted with US President Donald Trump’s announcement to levy tariffs on another 300 billion USD worth of Chinese goods from September 1.

Along with tax retaliation, the People’s Bank of China (PBOC) set the reference rate for the Yuan at 7.0 per dollar.

“This shows China’s willingness in trade negotiation with the US”, Linh said.

The US then declared China a “currency manipulator”; however, PBOC continued to devaluate its currency, making it decline to the lowest level in 25 years.

In the monetary market, the CYN/USD increased from 6,884 CYN/USD to 7.087 CYN/USD, equivalent to a rise of 3 percent per month.

Besides, the Chinese Government continued to inject money into the economy and changed interest rate management policy to enhance management capacity of the PBOC following negative signs of credit growth and poor industrial output and retail sales in July.

As ultra-loose monetary wave is dominant globally, 23 central banks decided to cut interest rates in August. According to the Central Bank News, nominal interest rates of 95 central banks in the world have dropped 38 percentage points since the beginning of the year.

“The development urges President Donald Trump to increase pressure on the Federal Reserve (FED). There is high possibility that FED will cut interest rates by 25 percentage points to 1.75-2 percent per year. Accordingly, value of USD will pick up and the USD Index (DXY) is expected to increase substantially to the band mark of 99, driving key currencies to fall, except for safe-haven currencies like JPY and CHF”, Linh believed.

Gold becomes a hot investment channel

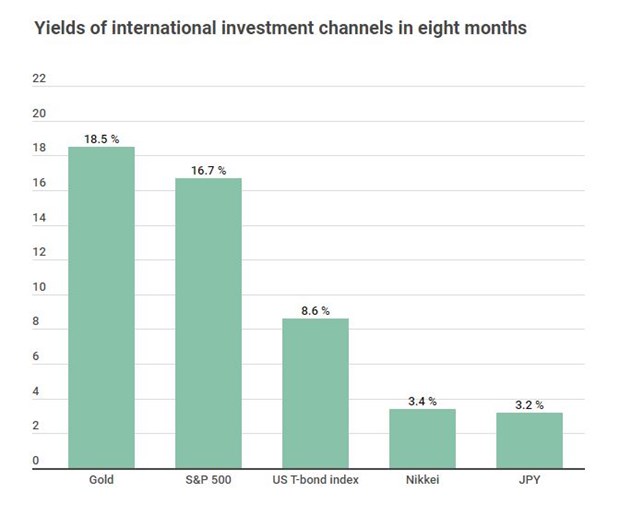

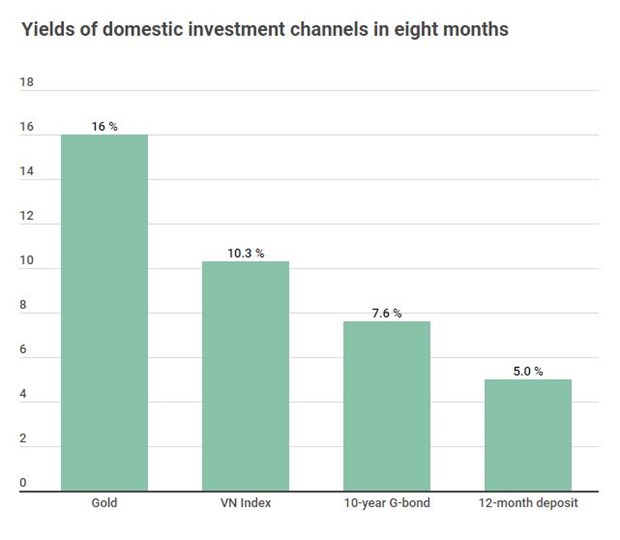

Gold has been described as the most profitable investment channel in both domestic and international markets in the past eight months.

To be more specific, global gold price soared 18.5 percent per year, making local gold surge 16 percent per year. Gold yielded more than stocks, bonds, deposits and JPY.

In the past, gold price hit its peak during 2008-2012 when the US was struggling with debt crisis, and FED had to maintain loose monetary policy. In the end of August 2011, gold reached all-time high of 1,918 USD an ounce, or 24 percent higher than current value. However, gold price plummeted from 2013.

Linh noted that “USD has become stronger, with its value 20 percent higher than the end of 2011. This means current gold price is approaching to the historical peak. As gold is a highly speculative metal, investors should stay prudent with their decisions this time”./.

(Source: Bloomberg, VietnamPlus)

(Source: Bloomberg, VietnamPlus) (Source: Bloomberg, VBMA, SSI, VietnamPlus)

(Source: Bloomberg, VBMA, SSI, VietnamPlus)