Jakarta (VNA) - Indonesia’s value-added tax (VAT) system is struggling to balance the need to generate sufficient revenue for public services while avoiding regressivity, according to an analysis published by the East Asia Forum.

The Australian newswire suggested that a progressive VAT system, featuring a single rate with real-time compensation for low-income earners, could offer a viable solution.

Indonesia’s tax-to-GDP ratio has stagnated at around 10-12% over the past decade, falling short of financing the increasing demand for investment in health, education, and infrastructure development.

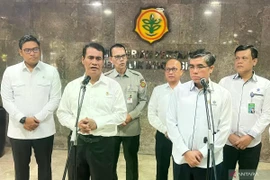

The Indonesian government initially proposed raising the VAT rate to 12% to strengthen revenue collection. However, in response to public concerns and protests, the policy was revised, maintaining the effective rate at 11%, with the 12% rate applied exclusively to luxury goods.

Citing global trends, the article pointed out that the average VAT rate worldwide stands at 15%, suggesting room for a modest rate increase in Indonesia.

The article also highlighted the regressive nature of VAT, which disproportionately impacts lower-income households that spend a larger share of their income on consumption.

It proposed that a modern VAT system could address this issue by incorporating a compensation mechanism that provides direct, real-time reimbursements to eligible low-income consumers.

Despite its potential benefits, implementing a progressive VAT system presents several challenges. The article warned of data privacy concerns, fraud risks, and the system’s intrusiveness, emphasising the need for robust regulations and enhanced transparency.

Strong data protection measures, including secure authentication protocols for both consumers and tax authorities, would be essential for safeguarding sensitive information.

The article concluded that the proposed system offers significant advantages despite these challenges. It argued that this approach goes beyond tax policy, serving as a blueprint for inclusive growth and positioning Indonesia as a potential high-income economy by 2045.

Successfully implementing a modern VAT in Indonesia could set a powerful precedent for other Southeast Asian nations./.