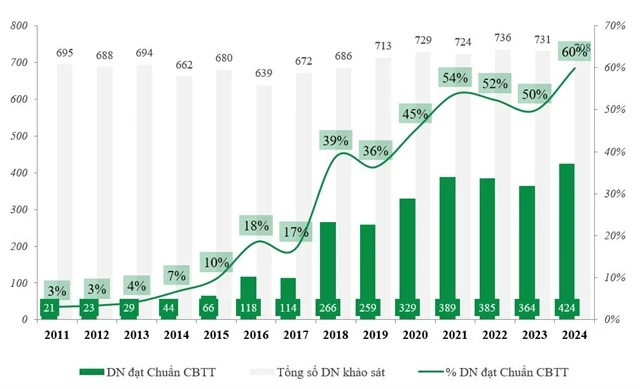

HCM City (VNS/VNA) - Some 424 out of 708 listed companies on the Hanoi and Ho Chi Minh stock exchanges surveyed have complied with information disclosure norms, 60 more than last year, a survey by the 2024 IR Best Practice Awards programme has found.

The annual survey was done between May last year and April this year by Vietstock, the Vietnam Association of Financial Executives and Finance and Life online magazine.

Disclosure is a mandatory obligation for all listed companies on the country’s two stock exchanges, and responsibility towards their shareholders and the investor community in general.

The ratio of listed companies fulfilling this obligation rose from 50% last year to 60% this year, the highest ever in the 14 years of the programme.

The large cap category had the highest compliance rate at 81% of companies in the financial sector and 65% in others.

Impressively, the compliance rate among small and micro cap companies increased to 58% from 46% last year. It was 60% for mid-cap companies.

In terms of industries, banking led with 18 out of 20 complying, or 90%, a huge jump from previous years, followed by mining (79%), food and beverage (77%) and utilities (76%).

Last year, the securities sector had the highest compliance ratio of 80%, but this year it dropped to 54%.

Construction and real estate had rates just below 50%.

The awards recognise achievements and honour listed companies that meet disclosure standards on the stock market.

After the survey, the programme will move to the evaluation phase of investor relations (IR) activities to nominate the winners of the IR Best Practice Awards./.

See more

Honda’s motorcycle, auto sales surge in Vietnam

Honda Vietnam said the strong February performance reflects the market’s recovery after the Tet holiday and the continued popularity of its strategic vehicle models.

Vingroup chairman enters Forbes’ Top 500 Richest

Vingroup’s chairman Pham Nhat Vuong entered the World's Top 500 Richest with estimated wealth at 6.7 billion USD.

Chu Lai International Port aims to become world-class logistics centre

Chu Lai International Port in Quang Nam Province has established itself as a key logistics hub for the central and Central Highlands regions and for neighbouring nations Laos and Cambodia, facilitating trade and contributing to the inter-regional economy.

Vietnam, Singapore strengthen cooperation in capital market, digital asset regulation

The State Securities Commission of Vietnam (SSC) and Monetary Authority of Singapore (MAS) have announced a partnership aimed at enhancing the integrity and stability of their capital markets.

Vietnam seeks French support for nuclear energy development

Vietnam will prioritise choosing partners who can commit to joining Vietnamese investors in technology transfer during the development of nuclear power in the country, said Prime Minister Pham Minh Chinh.

PM welcomes Pacifico Energy’s investment in Vietnam’s renewable sector

Prime Minister Pham Minh Chinh has welcomed the US-based Pacifico Energy (PE)’s plan and commitment to investing in Vietnam’s energy sector.

Congratulations to new Belarusian Prime Minister

Prime Minister Pham Minh Chinh on March 12 sent a congratulatory message to Alexander Turchin on his appointment as Prime Minister of the Republic of Belarus.

European Investment Bank helps Vietnam “unlock” green finance

The partnership will take advantage of the European bank’s Greening Financial Systems (GFS) technical assistance programme to strengthen Vietnam’s financial sector for climate investments.

Financial Times granted licence to reopen Vietnam bureau

With the reopening of the Financial Times' Vietnam bureau, the number of foreign news agencies with a permanent presence in the country has now risen to 30.

HCM City HortEx showcases agricultural technologies, smart farming

HortEx Vietnam 2025 also serves as a gathering place for businesses, cooperatives, and agricultural producers from more than 16 provinces and cities across Vietnam, providing an excellent opportunity for local enterprises to exchange knowledge, learn from international experience, access new technologies, and expand their markets.

Hyundai auto sales remain stable in February

In February, Hyundai Accent remained the best-selling model, with 455 units delivered to customers. It was followed by Hyundai Tucson with 403 units, Hyundai Stargazer with 304 cars, and Hyundai Creta with 303 vehicles.

PM requests stronger efforts to ensure comprehensive, equitable financial access

PM Pham Minh Chinh, who is also head of the steering committee, highlighted the significance of the strategy for the country's socio-economic development, saying that it enables individuals and businesses to access essential financial resources and services for development, improving living standards of the people, and promoting savings and investment.

Vietnam, Singapore deepen partnership with new industrial park project

Spanning 497.7 hectares with registered investment capital of some 161 million USD, it is designed to integrate green technologies, smart infrastructure, industrial symbiosis, and sustainable development principles, positioned to attract more investments to the province.

Vietnam’s economy poised to grow 6.8% this year: WB

“Vietnam is projected to maintain robust economic growth over the next two years, but it can use its fiscal space to better prepare for heightened uncertainties”, said Mariam J. Sherman, World Bank Director for Vietnam, Cambodia and Laos at a press conference.

VinFast’s EV sales in Vietnam surge 25%

VinFast’s February results continued its impressive domestic market performance.

HCM City retail property market expected to heat up

In 2025, the commercial real estate market, especially in HCM City, is forecast to undergo significant positive changes, with an improved supply. It can be said that this segment will "transform" to recover for a new growth cycle.

Measures needed to boost business optimism: VCCI

According to the Ministry of Planning and Investment, there are currently 940,000 active enterprises, falling short of the target of one million by 2020 and 1.5 million by the end of the year.

HCM City to use municipal budget for Metro Line No. 2 project

The Metro Line No. 2 project has an estimated investment of nearly 47.9 trillion VND (2 billion USD) and has nearly completed land clearance, at 99.8%. The NA’s Resolution 188 authorises HCM City to develop seven metro lines spanning 355 kilometres over the next decade, with preliminary total investment for the 2025-2035 phase estimated at 40.2 billion USD.

Reference exchange rate down 5 VND on March 12

The State Bank of Vietnam set the daily reference exchange rate for the US dollar at 24,758 VND/USD on March 12, down 5 VND from the previous day.

Corporate credit demand expected to keep rising this year

Credit for the individual customer segment last year slowed, while GDP last year recorded a strong recovery and household income growth remained low.