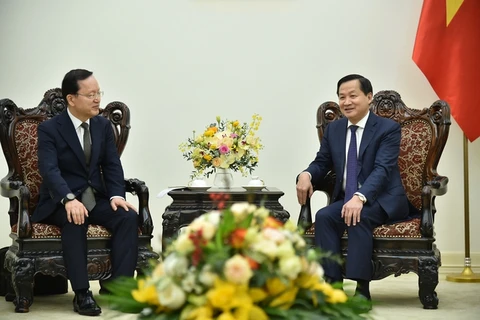

Chairman of the Party Central Committee’s Economic Commission Tran Tuan Anh (R) welcomes President of Samsung Vietnam Choi Joo-ho. (Photo: VNA)

Chairman of the Party Central Committee’s Economic Commission Tran Tuan Anh (R) welcomes President of Samsung Vietnam Choi Joo-ho. (Photo: VNA) The statement was made by Chairman of the Party Central Committee’s Economic Commission Tran Tuan Anh at his reception in Hanoi on February 24 for a working delegation of the Korea-based group led by Choi Joo-ho, President of Samsung Vietnam.

Appreciating the role of Samsung as the RoK’s largest investor in Vietnam, Anh affirmed that its placing of its largest research and development centre in Southeast Asia in Hanoi holds not only strategic significance for Samsung's investment activities in Vietnam but also great significance for Vietnam's foreign investment attraction activities, as well as bilateral cooperation in the context that the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the European Union - Vietnam Free Trade Agreement (EVFTA), and the Regional Comprehensive Economic Partnership (RCEP) have entered into force.

He proposed Samsung promote research - development activities and production and export of key products to the international market, step up cooperation in technology transfer, maintain investment in supporting industry and smart technology, and boost collaboration in research.

Choi thanked Vietnamese agencies for helping Samsung overcome difficulties caused by the COVID-19 pandemic, and creating a favourable environment for businesses’ operations.

Appreciating Vietnam’s socio-economic development orientations and achievements, he affirmed that Samsung will continue accompanying and cooperating closely with the country to contribute more to the bilateral relations./.

VNA