Hanoi (VNS/VNA) - Most steel companies recorded gloomy business results in the third quarter of 2022, according to a recent report on the construction and building materials industry by VNDirect Securities Corporation.

Revenues of the three largest listed steel companies, including Hoa Phat Group (HoSE: HPG), Hoa Sen Group (HSG), and Nam Kim Group (NKG), fell 25% year-on-year and 18% compared to the previous quarter due to weak steel demand resulting in reductions in both output and selling prices.

Moreover, high input prices, rising interest rates and a weakening dong have caused many businesses in the industry to record net losses in the third quarter of 2022. Vietnam's largest steel producer with the advantage of large-scale production, HPG, also posted a net loss of 1.8 trillion VND (74.9 million USD) in the last quarter, which is the company's first loss since the fourth quarter of 2008.

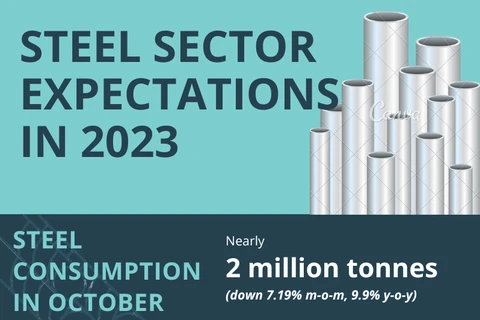

VNDirect also said that the domestic steel industry is being affected by difficulties such as high input material prices, including coke and scrap steel prices, and a decline in global steel demand, causing challenges for export activities of Vietnamese steel enterprises. Although disbursement of public investment is expected to accelerate in the coming quarters, VNDirect forecasts that consumption of construction steel and galvanised steel will both decrease by 3% year-on-year in 2023.

At the end of this year’s third quarter, all steel companies are in net debt. As a result, interest expenses will increase amid a higher interest rate environment.

However, the net debt to equity ratio of steel companies is still significantly better than in the 2010-2019 period.

VNDirect noted that some signals may be a premise for the steel industry to improve. For example, the price of coking coal is forecast to drop from 420 USD per tonne in 2022 to 258 USD and 220 USD per tonne in 2023 and 2024, respectively, as the coke mines return to normal operation, while iron ore prices are also forecast to gradually decrease in the long-term from an average of 110 USD a tonne in 2022 to 90 USD and 70 USD tonne in 2023 and 2024, respectively, as the loosening of China’s COVID-19 restrictions will stimulate global steel demand and accelerating infrastructure development in Vietnam will partly offset the stagnant real estate market.

Therefore, despite the fact that steel prices continue to decline in October and November, VNDirect still expects that the gross profit margin of steel companies will recover from the fourth quarter of 2022 when most of the high-priced inventories have been recorded in cost of goods sold in the previous quarter.

"We see that steel companies have reduced their inventory levels to only 2-3 months in the fourth quarter of 2022 from 4-5 months at the end of the second. This will reduce the risk from the provision for devaluation of inventories,” said VNDirect.

“In addition, the spot prices of input materials like iron ore, coke, and scrap steel, are also gradually returning to an average level. Therefore, steel companies’ profit will soon hit the bottom, but the recovery will be quite slow due to weak steel demand.”/.

Revenues of the three largest listed steel companies, including Hoa Phat Group (HoSE: HPG), Hoa Sen Group (HSG), and Nam Kim Group (NKG), fell 25% year-on-year and 18% compared to the previous quarter due to weak steel demand resulting in reductions in both output and selling prices.

Moreover, high input prices, rising interest rates and a weakening dong have caused many businesses in the industry to record net losses in the third quarter of 2022. Vietnam's largest steel producer with the advantage of large-scale production, HPG, also posted a net loss of 1.8 trillion VND (74.9 million USD) in the last quarter, which is the company's first loss since the fourth quarter of 2008.

VNDirect also said that the domestic steel industry is being affected by difficulties such as high input material prices, including coke and scrap steel prices, and a decline in global steel demand, causing challenges for export activities of Vietnamese steel enterprises. Although disbursement of public investment is expected to accelerate in the coming quarters, VNDirect forecasts that consumption of construction steel and galvanised steel will both decrease by 3% year-on-year in 2023.

At the end of this year’s third quarter, all steel companies are in net debt. As a result, interest expenses will increase amid a higher interest rate environment.

However, the net debt to equity ratio of steel companies is still significantly better than in the 2010-2019 period.

VNDirect noted that some signals may be a premise for the steel industry to improve. For example, the price of coking coal is forecast to drop from 420 USD per tonne in 2022 to 258 USD and 220 USD per tonne in 2023 and 2024, respectively, as the coke mines return to normal operation, while iron ore prices are also forecast to gradually decrease in the long-term from an average of 110 USD a tonne in 2022 to 90 USD and 70 USD tonne in 2023 and 2024, respectively, as the loosening of China’s COVID-19 restrictions will stimulate global steel demand and accelerating infrastructure development in Vietnam will partly offset the stagnant real estate market.

Therefore, despite the fact that steel prices continue to decline in October and November, VNDirect still expects that the gross profit margin of steel companies will recover from the fourth quarter of 2022 when most of the high-priced inventories have been recorded in cost of goods sold in the previous quarter.

"We see that steel companies have reduced their inventory levels to only 2-3 months in the fourth quarter of 2022 from 4-5 months at the end of the second. This will reduce the risk from the provision for devaluation of inventories,” said VNDirect.

“In addition, the spot prices of input materials like iron ore, coke, and scrap steel, are also gradually returning to an average level. Therefore, steel companies’ profit will soon hit the bottom, but the recovery will be quite slow due to weak steel demand.”/.

VNA