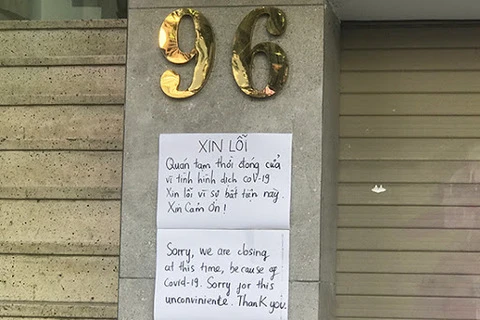

Hanoi (VNS/VNA) - The COVID-19 pandemic has become a golden opportunity for e-commerce trading floors, as well as social networks such as Facebook. However, the country has lost billions of dong in tax revenue due to e-commerce as there are no specific regulations on the sector.

During the pandemic, owners of these platforms have seen business increase as people stay at home and spend more online.

Streaming platforms are also becoming more popular, including Iflix of Malaysia, WeTV of China and Netflix from the US.

In Vietnam, Netflix started providing services from early 2016 with packages ranging from 180,000 VND to 260,000 VND per month. The total number of paid subscribers in Vietnam has reached over 300,000, meaning Netflix could earn hundreds of billions of dong from the country. However, most Netflix subscribers in Vietnam register to use the service and pay fees online or by credit card.

Nguyen Duc Huy, Deputy Chief Officer of the General Department of Taxation, told Tien Phong (Vanguard) Newspaper that Netflix has not set up a branch in Vietnam yet. This enterprise has not done the necessary procedures to obtain a license to provide online TV services in the country, leading to tax losses. However, the tax industry does not have specific sanctions for this case.

Deputy head of the Hanoi Taxation Department Vien Viet Hung told the newspaper that more individuals are earning an income from YouTube, Facebook and app markets such as the Google Playstore and iOS Appstore. According to Circular 92/2015/TT-BTC guiding the implementation of the Law on Value Added Tax (VAT) and Personal Income Tax (PIT) for resident individuals having business activities, individuals with income from a business with turnover from 100 million VND a year or more must pay tax. Individuals receiving income from Facebook, Google and YouTube are classified as business individuals, paying tax at the rate of 5 percent VAT and 2 percent PIT.

The department identified more than 1,100 individuals operating in software, electronic services and online games had a total income of 4.8 trillion VND in the last three years (2016-19). Of which one person had an income of up to 140 billion VND. As of July 24, more than 100 individuals registered, declared and paid more than 10 billion VND in PIT and VAT on total revenue of more than 151 billion VND. However, the department assessed that the proportion of individuals earning income from e-commerce activities voluntarily implementing tax obligations was still low.

Dang Ngoc Minh, deputy director of the General Department of Taxation said the tax industry has cooperated with relevant agencies to control the money flow transferred from abroad to local organisations and individuals. At the same time, through inspections, the General Department of Taxation has collected a huge amount of tax.

In Hanoi, since 2017, the tax department has reviewed and sent SMS notifications to 13,422 Facebook accounts involved in online sales. Up to now, over 2,000 individuals have registered and were issued with a tax identification number used to declare and pay taxes. The total taxes and fines collected from this type of business totalled more than 22.7 billion VND.

For organisations and individuals with incomes from foreign social networks (Google, Facebook, YouTube), through data from joint-stock commercial banks, there were more than 18,300 opening accounts at banks with a total income of 1.46 trillion VND.

The total amount of tax, fines and late payment interest collected from accounts on foreign social networks was about 14 billion VND.

He said the department is inspecting service providers selling through e-commerce. They collected a list of 9,510 cases of business activities on the e-commerce floors provided by a firm with the total amount arising from withdrawals of 211 billion VND.

For house rental activities, specifically organisations and individuals posting information through foreign websites, the tax authority has reviewed 483 addresses. Of which, 107 organisations have paid about 9.4 billion VND while 68 individuals have paid 634 million VND.

Minh said, in 2019, the General Department of Taxation inspected and discovered that one individual received 41 billion VND from Google for providing advertising services on a game, but had not declared or pay tax. The inspection team retrospectively collected and fined more than 4 billion VND.

In order to properly and fully manage and collect taxes from organisations and individuals in e-commerce and online services, he said that the tax department will co-ordinate with the Ministry of Public Security and the Ministry of Information and Communications to identify taxpayers. They would also collect data from shipping companies, intermediary apps, banks and e-wallets to determine cash flow. The General Department of Taxation would thus better manage taxes for organisations and individuals./.

VNA