Hanoi (VNS/VNA) - Vietnamese banks' profitability is expected to be squeezed following their provision of debt relief to support borrowers affected by a recent deadly typhoon, according to the latest report by S&P Global Ratings.

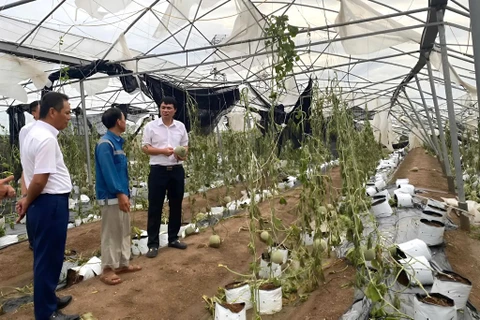

The State Bank of Vietnam (SBV) have directed banks to offer debt relief to individuals and businesses devastated by Typhoon No. 3 (Yagi), which caused widespread destruction this month, leading to significant property damage and fatalities, particularly in northern regions.

In response, banks are expected to lower lending rates by 0.5% to 2% for both new and existing borrowers until the end of 2024. The scale of the relief provided will depend on the severity of damage faced by borrowers.

This debt relief effort comes at a time when banks in Vietnam are already grappling with declining asset yields, S&P Global Ratings said in the report.

The banking sector has been competing aggressively to lend to high-quality borrowers as part of efforts to meet the SBV’s credit growth target of 15%, amid slowing demand for loans. Shrinking domestic consumption has further impacted credit demand, with many banks already experiencing reduced margins.

Lowering interest rates as part of the debt relief measures will only add further strain on banks' profitability, it said.

According to the SBV, banks are prepared to offer up to 405 trillion VND (16.2 billion USD) in preferential loans with reduced interest rates, representing about 3% of the sector's total outstanding loans.

State-owned commercial banks (SOCBs) are expected to be the most affected by these relief measures due to their extensive networks in the northern regions, where the damage from Typhoon Yagi was most severe.

For example, Vietcombank, one of the four SOCBs, has an estimated 160 trillion VND in outstanding loans that are eligible for debt relief. This amounts to approximately 12% of the bank’s total loan portfolio, significantly higher than the 3% average across the sector.

However, it is believed that Vietcombank will manage this impact well due to its strong profitability. For the second quarter of 2024, the bank reported an annualised return on assets of 1.73%, positioning it as the most profitable SOCB in the country.

Privately owned commercial banks are also offering debt relief but on a smaller scale than SOCBs, given their relatively smaller loan books.

According to S&P Global Ratings, the coming year will be a critical test for the asset quality of Vietnamese banks. While the debt relief may temporarily ease the repayment burden for borrowers and help maintain stable non-performing loan (NPL) ratios, it could create challenges once the relief period and the Circular 02 loan-structuring policy expire at the end of 2024.

As these measures come to an end, NPLs may rise, forcing banks to set aside additional provisions, which could further impact the profitability of the sector. With the domestic real estate market still recovering, the full effects of this crisis on the banking system are yet to be seen, it said./.