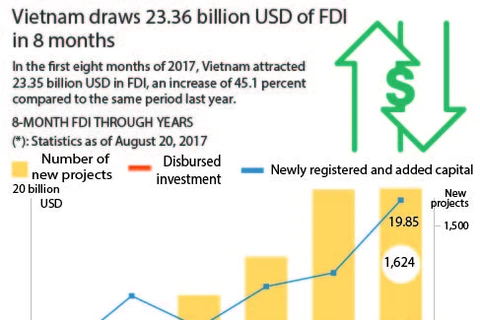

HCM City (VNS/VNA) - In the first eight months of the year Vietnam attracted foreign investment worth more than 23.36 billion USD, a year-on-year increase of 45.1 percent.

Though it was rightly hailed by all, the Ministry of Planning and Investment (MPI) in a recent report listed several shortcomings, one of which was the rapid increase in the number of projects with very little capital.

In fact, the number of projects with capital of below 1 million USD accounted for 65 percent of all projects during this period.

The average size was 3.8 million USD, rather modest, according to experts.

Experts have been warning for a long time that foreign-owned projects are getting smaller, but the issue has not been addressed so far.

For instance, last year the Cửu Long (Mekong) Delta province of An Giang attracted only one foreign project and it was worth all of 20,000 USD.

Similar sized projects have been seen even in major cities like Hanoi, Da Nang and HCM City.

HCM City last year licensed 836 FDI projects whose capital added over 1 billion USD, meaning each was worth nearly 1.2 million USD.

In Da Nang too, most FDI projects last year averaged around 1 million USD worth of capital.

Analysts said though the Government makes great efforts to attract investors, the number of those from countries like the US, Germany and France remains modest, with many big players still hesitant to invest in Vietnam.

This is because Vietnam has yet to really meet three requirements: publicity for and transparency in fighting against corruption; preventing violations of intellectual property rights and the continuing problem of red tape though Vietnam has made great progress in administrative reform.

Some experts blame the situation on authorised agencies’ poor ability to assess FDI projects before granting investment licences.

One of the consequences is that many FDI projects have limited resources and use outdated technology and equipment that cause pollution.

Analysts said there are differences between the FDI regimes of Vietnam and other countries, explaining that Vietnam is very careful in granting licences but is lax in overseeing their business activities.

On the other hand, others make it easy for foreign investors to get licences but carefully monitor their activities subsequently.

After reviewing FDI inflows in the last few years, MPI experts realised the necessity to fix a minimum capital requirement for foreign investors wanting to come to the country.

Small projects, including foreign-invested ones, often face major challenges in their early days caused by their size. They focus on assembling instead of production, their use of local content is low, their exports are mainly based on outsourcing, they are labour-intensive – as in the so-called, much derided sweat shops -- and create little value addition.

They are of little help to the Vietnamese economic or business set-up because they are unable to transfer technology to local companies, thus failing the Government’s policy of attracting FDI to help improve domestic technological capacity.

The ratio of FDI companies in the manufacturing and processing sectors has plummeted in recent years to 20-30 percent from 70-80 percent earlier.

A majority of them have capital ranging from a few dozen thousands of dollar to hundreds of thousands of dollar and use simple technologies.

Analysts stressed the need to attract FDI selectively to improve quality and allow only domestic companies in areas where they can do well.-VNA

Though it was rightly hailed by all, the Ministry of Planning and Investment (MPI) in a recent report listed several shortcomings, one of which was the rapid increase in the number of projects with very little capital.

In fact, the number of projects with capital of below 1 million USD accounted for 65 percent of all projects during this period.

The average size was 3.8 million USD, rather modest, according to experts.

Experts have been warning for a long time that foreign-owned projects are getting smaller, but the issue has not been addressed so far.

For instance, last year the Cửu Long (Mekong) Delta province of An Giang attracted only one foreign project and it was worth all of 20,000 USD.

Similar sized projects have been seen even in major cities like Hanoi, Da Nang and HCM City.

HCM City last year licensed 836 FDI projects whose capital added over 1 billion USD, meaning each was worth nearly 1.2 million USD.

In Da Nang too, most FDI projects last year averaged around 1 million USD worth of capital.

Analysts said though the Government makes great efforts to attract investors, the number of those from countries like the US, Germany and France remains modest, with many big players still hesitant to invest in Vietnam.

This is because Vietnam has yet to really meet three requirements: publicity for and transparency in fighting against corruption; preventing violations of intellectual property rights and the continuing problem of red tape though Vietnam has made great progress in administrative reform.

Some experts blame the situation on authorised agencies’ poor ability to assess FDI projects before granting investment licences.

One of the consequences is that many FDI projects have limited resources and use outdated technology and equipment that cause pollution.

Analysts said there are differences between the FDI regimes of Vietnam and other countries, explaining that Vietnam is very careful in granting licences but is lax in overseeing their business activities.

On the other hand, others make it easy for foreign investors to get licences but carefully monitor their activities subsequently.

After reviewing FDI inflows in the last few years, MPI experts realised the necessity to fix a minimum capital requirement for foreign investors wanting to come to the country.

Small projects, including foreign-invested ones, often face major challenges in their early days caused by their size. They focus on assembling instead of production, their use of local content is low, their exports are mainly based on outsourcing, they are labour-intensive – as in the so-called, much derided sweat shops -- and create little value addition.

They are of little help to the Vietnamese economic or business set-up because they are unable to transfer technology to local companies, thus failing the Government’s policy of attracting FDI to help improve domestic technological capacity.

The ratio of FDI companies in the manufacturing and processing sectors has plummeted in recent years to 20-30 percent from 70-80 percent earlier.

A majority of them have capital ranging from a few dozen thousands of dollar to hundreds of thousands of dollar and use simple technologies.

Analysts stressed the need to attract FDI selectively to improve quality and allow only domestic companies in areas where they can do well.-VNA

VNA