Vietnam's logistics sector has a lot of potential but it is currently fragmented. Therefore, in order to create momentum, it is necessary to create policies that attract investment from the business community.

As much was said so at the workshop themed "Improving competitiveness of logistics service businesses", which was organized by Industry and Trade Newspaper in collaboration with Import-Export Department under the Ministry of Industry and Trade and the Ministry of Transport in Hanoi on April 28.

Logistics costs still high

According to data from the Vietnam Logistics Business Association, currently 90% of operating logistics enterprises are local, but only account for about 30% of the market share. The balance of the business belongs to foreign firms, who are giants in the business with a lot of experience and capital.

Notably, the number of enterprises is large but the size of these enterprises is small. This means they have limited scale in terms of both capital, human resources, and international operation experience. There is no link between stages in the logistics supply chain and between logistics service enterprises and import-export enterprises.

Not only that, the number of enterprises providing integrated logistics services (3PL: providing third-party logistics services or logistics under contract) and 4PLs (providing fourth-party logistics services or distribution chain logistics) in southern Vietnam is still modest.

The proportion of 3PL and 4PL enterprises only accounts for 16% of the total number of enterprises in the logistics industry (Vietnam logistics report 2019).

This means Vietnam’s logistics costs are higher than other countries in the world, creating a barrier to market competitiveness.

According to Truong Tan Loc, Marketing Director of Saigon Newport Corporation, among many difficulties and obstacles, the sudden increase in fuel prices in 2022 (up about 33% compared to the average price in 2021) hit companies hard.

Moreover, lack of control over goods in transit through border gates causes great difficulty for shipping lines and customers.

For example, there are time and cost increases associated with the high inspection rates, lengthy inspection times, storing containers, and delay in delivering raw materials into production.

Some items are in transit but are subject to the same procedures as import/export goods and the domestic market. Things such as sub-licensing for quarantine, sub-licensing for quotas hold the industry back, especially during the pandemic.

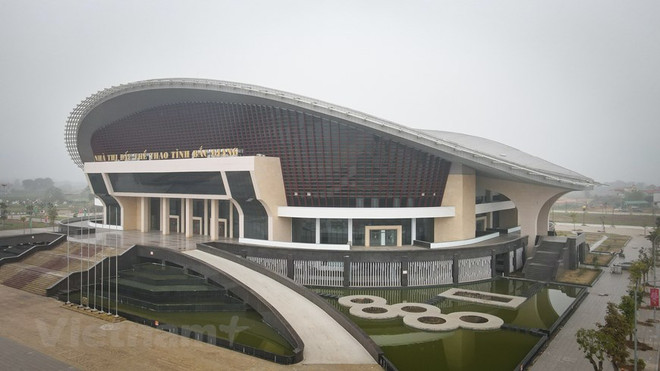

Delegates attending the workshop on improving the competitiveness of logistics service enterprises (Photo: Vietnamplus)

Delegates attending the workshop on improving the competitiveness of logistics service enterprises (Photo: Vietnamplus)

In addition, the road transport system is not synchronous and has not been built according to any schedule. The belt 2, construction of belts 3 and 4, Dong Nai-Vung Tau expressway constructions are in disarray. These are critical to connect industrial parks, and provincial motorways with seaport systems.

According to Pham Thi Lan Huong, representative of Vinafco, in the 3PL segment, most of the world's leading logistics enterprises have penetrated Vietnam and account for a large proportion of revenue compared to domestic enterprises.

Foreign enterprises account for 75% of the market share and the remaining 25% belongs to Vietnamese enterprises.

This poses many challenges for Vietnamese enterprises in terms of competition, service quality, application of information technology, as well as human resources.

With the Fourth Industrial Revolution, traditional logistics centres have been switched to new-generation high-tech sites, she said. An action plan to enhance the competitiveness and development of the Vietnamese logistics sector until 2025 has been implemented to cut costs and improve efficiency in the sector./.