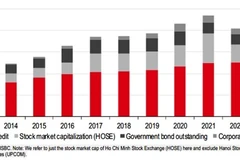

HCM City (VNA) - Ho Chi Minh City saw an unexpected positive credit growth in January, a surprising result given that credit typically declines in the early months of the year due to its seasonal nature associated with the Lunar New Year (Tet).

Nguyen Duc Lenh, Deputy Director of the State Bank of Vietnam's Ho Chi Minh City branch, stated that as of the end of January, the city's total credit balance had reached over 3.94 quadrillion VND (154.6 billion USD), up 0.04% from the end of 2024, and 12.43% year-on-year.

He attributed the growth to favourable factors such as strong expansion in trade, services, and tourism, as well as an increase in export orders.

Additionally, factors related to monetary and credit policies like interest rates, credit quotas, and preferential loan packages, made it easier for businesses to access credit, further boosting credit growth in the city, he said.

This will serve as a key driver to maintain growth in the coming months, helping to achieve the set goals and supporting businesses, ultimately contributing to economic growth as planned, he added.

According to Lenh, in the coming period, the city’s banking sector will focus on effectively implementing the bank-business connectivity programme, along with disbursing credit packages to support small- and medium-sized enterprises (SMEs), as well as the export and consumption, to meet the capital needs of businesses and households for growth and development.

Notably, regarding the bank-business connectivity programme, preliminary statistics show that 18 credit institutions have registered to participate in the credit package, with a total loan amount of nearly 200 trillion VND at preferential interest rates. This programme is a concrete action and practical solution to support enterprises and promote economic growth, he noted./.