HCM City (VNA) — HSBC Global Research's latest report “Vietnam at a glance - Let’s talk capital” has stressed the country's potential upgrade this year to emerging market status.

The report, released on February 11, emphasises the country's expanding capital mobilisation channels and provides insights into trade, imports, exports and tariffs.

Vietnam was the best stock market performer in Southeast Asia in 2024.

However, recent quarters have also seen some pullback in portfolio investment flows from foreign investor. Albeit mostly driven by macro developments, this nevertheless poses the question, are there roadblocks inhibiting foreign interest and participation in Vietnam’s stock market? And indeed, structural challenges persist, says the report.

These include transaction and infrastructure-related hurdles, relatively less corporate transparency and disclosures.

But changes are underway. Effective November 2024, Vietnam has scrapped the pre-funding requirement for stock market transactions, clearing a significant criterion to upgrade its designation from a frontier market to an emerging market, potentially later this year. The country has been on the watchlist since 2018. If implemented, FTSE Russell, a major index provider, estimates that an upgrade in designation could bring 6 billion USD or over one percent of GDP in foreign investment inflows into the country.

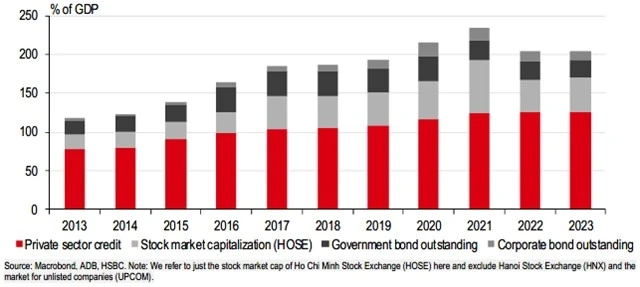

Such focus is particularly significant for Vietnam, which has lagged ASEAN peers in terms of stock market development. In contrast, bank lending has grown substantially relative to the size of its economy, indicating that credit primarily supported the high growth trend observed over the years.

However, a large dependency on credit can lead to amplifying economic adjustments in an adverse manner, such as when borrowing costs rose in late 2022. When the economy experienced acute inflation shortly after the pandemic and the State Bank of Vietnam (SBV) responded accordingly by tightening monetary policy, credit growth slowed sharply as pressures flowed across many areas in the domestic sector, particularly in banking and real estate, which is included under other services.

In this context, developments to improve capital markets should not only be seen as catching up to market peers but also in terms of diversifying and expanding capital mobilisation channels to build financial resilience.

Despite the stock market being larger in size relative to its bond market, actual capital raised in the equity market only amounted to 10% of funds raised in the corporate bond market through 2019-23. The dominant presence of the banking sector is also reflected in these markets, of which the banking sector traditionally and continues to encompass the majority of corporate bond issuances. Other sectors, such as manufacturing and retail, evidently face greater challenges in accessing sources of funding other than bank credit, potentially limiting an efficient allocation of capital and constraining activity.

The Government has been taking steps to address various challenges and risks surrounding capital markets. Following the challenging market environment for corporate bonds in late 2022, the authorities have introduced more safeguards to allay investor concerns, such as allowing only professional investors to participate in the trading of corporate bonds via private placement.

Meanwhile, structural reforms to improve transparency and information disclosure to accommodate a global investor base are also underway. In comparison to other ASEAN peers that have already adopted International Financial Reporting Standards (IFRS), not all corporations in Vietnam have shifted from Vietnam Accounting Standards (VAS) and adopted IFRS yet, leading to valuation differences. Encouragingly, 2025 is a key year in the transition plan set forth by the government, as IFRS adoption shifts from being voluntary to compulsory for public companies from this year onward.

Introducing more transparency has also been the case in other areas of the economy, such as the real estate market. Regulatory changes in the 2024 Land Law, 2023 Housing Law, and 2023 Real Estate Business Law have supported newly registered FDI to flow into the sector, registering 4 billion USD in 2024, up from 1 billion USD in 2023. Notable changes, such as land prices better reflecting market values, easing land-related rights for overseas Vietnamese, and more stringent information disclosure by real estate businesses, will continue to support a recovery in sentiment.

Beyond increasing foreign participation in capital markets, expanding and diversifying the domestic investor base will be key in helping to sustainably achieve the official targets of a stock market capitalisation of 120% and corporate bonds outstanding of 25% of GDP, respectively, by 2030. Indeed, the presence of institutional investors in both spaces has notable room to grow./.