Hanoi (VNA) - The financial and monetary policies in recent times have been adjusted flexibly to support and stimulate consumption, and stabilise prices. In the coming period, these policies will continue to be implemented in a coordinated manner to control inflation.

Policies regarding tax, fee, and charge exemptions, reductions, and extensions put in place

According to the Ministry of Finance (MoF), the Consumer Price Index (CPI) for 2024 increased by 3.63% compared to 2023, fulfilling the targets set out by the National Assembly and Government. The index in January 2025 rose by 0.98% compared to December 2024, mainly due to the impact of adjustments in healthcare service fees at the local level, as well as increased food prices and transportation services during the peak demand of the Lunar New Year (Tet) holiday. Compared to the same month last year, it increased by 3.63%.

To stabilise the macro-economy, control inflation according to the target set out by the legislature, and implement the roadmap for market pricing of public services and goods managed by the state, fiscal policies have contributed significantly.

The MoF stated that it has proactively implemented the assigned tasks, and proposed, developed, and submitted to the relevant authorities for issuing and promptly carrying out fiscal policies. These efforts, in conjunction with the implementation of monetary policies and other macroeconomic policies, aim to solve difficulties for businesses and the public, stabilise the macroeconomy, control inflation, ensure the balance of the economy, promote economic growth, and secure social welfare and people's livelihoods.

The ministry submitted to the Government and relevant authorities the issuance and implementation of policies for tax, fee, and charge, and land lease fee exemptions, reductions, extensions for businesses and citizens. The total amount of money in 2024 was estimated at around 197.3 trillion VND (7.7 billion USD), of which approximately 99 trillion VND came from exemptions and reductions, and about 98.3 trillion VND from extensions.

Currently, in order to continue supporting businesses and citizens, the Ministry of Finance has presented to the Government, the National Assembly, and its Standing Committee proposals for tax reduction policies to take effect in 2025. Specifically, these include a 2 percentage point reduction in the VAT rate for certain groups of goods and services currently taxed at 10% for the first six months of 2025, and a 50% reduction in environmental protection tax on petrol, diesel, and lubricants applicable for this year.

Monetary policy managed proactively, flexibly, effectively

In terms of the monetary policy, in 2024, the State Bank of Vietnam (SBV) managed it proactively, flexibly, and effectively, and coordinated it with fiscal policies and other macroeconomic policies in a smooth, harmonious, and close manner.

Accordingly, the required reserve ratio for credit institutions was kept stable; credit management was conducted proactively and flexibly to meet the capital needs of the economy. The interest rates in 2024 were maintained at the same level to allow credit institutions to access funding from the central bank at low costs, contributing to supporting the economy. The exchange rate was managed flexibly and appropriately to help mitigate external shocks.

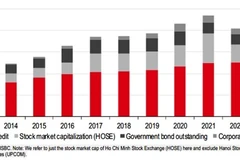

As a result, credit growth last year improved compared to the previous year. As of December 31, 2024, credit growth across the economy had increased by 15.08% compared to the end of the previous year. The foreign exchange market remained stable, with smooth foreign currency liquidity, and the legitimate foreign currency needs of the economy were fully met. The exchange rate developed flexibly in both directions, in line with market conditions. By December 31, 2024, the average transaction exchange rate had risen by 5.03% compared to the end of the previous year.

Analysts forecast that in 2025, Vietnam will face significant challenges that will have a strong impact on the exchange rate and inflation, especially when domestic and global demands for goods have not fully recovered. Therefore, it is necessary to take advantage of the available room to expand fiscal policies in order to meet the growth target of 8% for 2025.

Dr. Can Van Luc, a member of the National Financial and Monetary Policy Advisory Council, stated that the monetary policy for 2025 needs to be flexible to stabilise the exchange rate, control inflation, and promote growth./.