Hanoi (VNA) - The coffee sector has emerged as the brightest star in agricultural exports this year. Between January and July 2025, coffee became the leading export product, contributing 6 billion USD out of nearly 40 billion USD in agricultural export value.

A price surge and quality upgrade

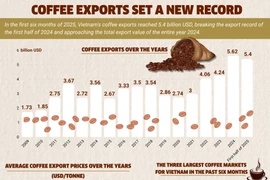

Nguyen Nam Hai, Chairman of the Vietnam Coffee – Cocoa Association (VICOFA), revealed that in the first seven months of 2025, coffee exports reached 1.1 million tonnes worth 6 billion USD – a year-on-year rise of 7.4% in volume and a staggering 65% in value. For the first time, Vietnam’s coffee exports hit the 6 billion USD mark, surpassing last year’s record of 5.62 billion USD after just seven months.

Over the first ten months of the 2024/2025 crop year (October 2024 – September 2025), Vietnam exported about 1.35 million tonnes of coffee with turnover of roughly 7.5 billion USD, down 1.1% in volume but up 56.6% in value against the same period of the previous crop year. This marks the first season in which coffee export value has exceeded 7 billion USD – and the sector is well on course to break the 8 billion USD barrier by the end of the crop year on September 30.

This boom is driven primarily by a global price surge. Supply shortages linked to climate change and the El Niño phenomenon have pushed coffee prices to unprecedented highs. The average export price of Vietnamese coffee in the first seven months stood at over 5,670 USD per tonne, more than 53% higher than the same period last year.

Equally crucial has been the steady upgrade in quality. According to the Ministry of Industry and Trade’s Agency of Foreign Trade, enterprises have invested heavily in deep processing and traceability. The effective use of free trade agreements such as the EU-Vietnam Free Trade Agreement (EVFTA) and Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) have also opened access to demanding markets, significantly enhancing the value of Vietnamese coffee.

According to the Ministry of Agriculture and Environment, growth has been broad-based across both traditional and emerging markets.

Europe remains Vietnam’s largest buyer, importing 3.6 billion USD worth of products. Germany led the way with an extraordinary 113.1% increase, followed by Italy (up 47.4%) and Spain (up 67%).

In the Americas, the US saw a remarkable 76.4% rise, while exports to Mexico skyrocketed 88-fold.

Asia has also shown robust demand, with shipments to Japan up 56.5%, the Republic of Korea up 69.3%, and China up 24.4%.

The ministry has mapped out market-specific strategies – speciality and value-added coffee for the US; boosting Robusta exports to North-East Asia; and tapping into high-potential destinations such as India and the Philippines.

Seizing the “golden moment”

As the year draws to a close, Vietnam’s coffee is set to retain advantages in export markets.

The EU’s new deforestation regulation (EUDR), effective from January 1, 2026, is seen as a “golden opportunity” given Vietnam’s readiness to comply – making it one of the very few leading exporters positioned to meet the new requirements.

In the US, a reciprocal tariff of up to 50% imposed on Brazilian goods – Vietnam’s chief rival in this market – is expected to push up Brazilian coffee prices sharply. This presents a rare chance for Vietnamese coffee, with its lower tariff rates, to consolidate its foothold.

Nevertheless, challenges remain. Many enterprises are grappling with capital constraints and tax burdens. To support the industry, VICOFA has proposed the Ministry of Finance exempt raw green coffee from the value added tax (VAT), arguing that such a move would ease financial pressure and create momentum for growth.

With record-breaking results already achieved and major opportunities ahead, the 7.5 billion USD target for 2025 is well within reach – laying a firm foundation for Vietnam’s coffee industry to grow sustainably and prosper into the future./.