Hanoi (VNS/VNA) - In the dynamic global economic landscape, the asset management sector is emerging as a standout field, with rapid growth fuelled by wealthy, middle-class and high-net-worth investors, transitioning towards professional asset management models and high-tech applications.

According to a 2023 Knight Frank report, Vietnam boasts 19,400 US-dollar millionaires, marking a 98% increase over the past decade, which includes six billionaires and 58 individuals with over 100 million USD in assets.

The robust development of the affluent and middle-class is driving demand for estate management services as individuals and family businesses focus on optimising assets and long-term financial planning.

McKinsey forecasts a 20% annual market growth rate in this sector, with revenue projected to increase by 23% annually over the next three years.

By 2027, the Vietnamese estate management market is expected to reach approximately 130 billion USD.

For highly liquid assets like stocks and bonds, the Assets Under Management (AUM) in Vietnam has surged from 95 trillion VND (4.5 billion USD) in 2014, to over 600 trillion VND (25 billion USD) in 2023, equivalent to 5.7% of GDP, according to the State Securities Commission of Vietnam (SSC).

Compared to other markets in the region such as Thailand, Malaysia (30 - 40% of GDP), or developed countries and territories like Taiwan (China), the Republic of Korea (60 - 67% of GDP), Vietnam still holds significant development potential.

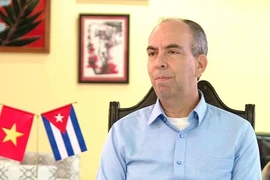

CEO of Thien Viet Asset Management JSC Tran Vinh Quang said that the middle class is experiencing significant growth and the expected upgrade of the stock market will be a driving force propelling the asset management industry to reach remarkable heights in the coming decade.

Moreover, the increasing savings rate for investment from the middle-income investor group, reaching 10 - 12% annually, is expanding opportunities for the market.

These factors provide a solid foundation for asset management companies in Vietnam to develop comprehensive financial solutions, meet customer needs and enhance competitive capabilities in both regional and international markets.

The asset management sector in Asia is rapidly evolving, presenting significant opportunities for Vietnam. Domestic clients prioritise sustainable financial solutions, reasonable risks and deep market understanding.

This scenario, both an opportunity and a challenge, demands enterprises to innovate, digitise and improve service quality to meet increasingly high expectations.

The future of Vietnam's asset management industry will depend on continuous innovation and technology applications to address the diverse needs of customers./.