Hanoi (VNA) – Credit growth across the banking sector reached 15.08% as of the end of 2024, exceeding the year’s target of 15%, according to Standing Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu.

At the press conference held in Hanoi on January 7 highlighting the central bank’s operation in 2024 and tasks for this year, Tu said outstanding loans totalled 15.6 quadrillion VND (approximately 614.6 billion USD), marking an increase of over 2 quadrillion VND as compared to 2023. The credit growth primarily focused on production, business operations, and priority sectors of the economy.

2024 saw more relaxed global economic and trade policies, which helped ease pressure on Vietnam's monetary policy implementation, he said, adding business activities showed marked improvement, leading to increased capital demand from enterprises.

However, challenges persisted throughout the year, with multiple firms having limited access to capital, while the bond and stock markets having yet to fully recover, affecting long-term capital availability. The realty market, though showing signs of warming up, still struggled with legal procedures for numerous projects, according to Tu.

Against the backdrop, the central bank strictly followed the Party, National Assembly, and Government’s resolutions and kept close tabs on the global and domestic economic developments to harmoniously roll out measures facilitating access to bank credit for businesses and individuals, supporting business recovery, and promoting growth.

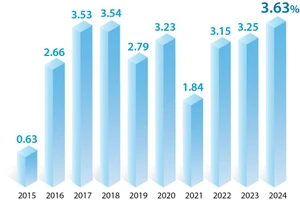

In terms of monetary policy achievements, the SBV's management contributed to macroeconomic stability, with economic growth reaching 7.09%, surpassing the National Assembly's target of 6.5%. Meanwhile, inflation was successfully contained at 3.63% compared to 2023, meeting the set target.

Tu went on to say that the central bank demonstrated sound management of interest rates in the year, maintaining steady policy rates despite global highs. While deposit rates saw a 0.71% increase, lending rates fall by 0.6% overall, with state-owned commercial banks leading the reduction at nearly 1%.

Furthermore, a flexible exchange rate policy helped successfully navigate external shocks while ensuring market stability and adequate foreign currency supply.

In a move to bolster economic growth, the SBV launched two adjustments to credit growth targets in August and November while asking credit institutions to work to improve business efficiency, ensure the system’s safety, stabilise the monetary market, and prioritise credit for sectors that are drivers of the economic expansion.

Besides, the banking sector initially control the price gap between domestic SJC gold bars and international prices, Tu stated, adding despite economic headwinds, the banking system maintained stability and kept non-performing loans under control while protecting depositors’ interests.

Looking ahead, Tu said the central bank will continue keeping a close watch on the market development as well as external and domestic economic situations to carry out comprehensive solutions to control inflation, contributing to macroeconomic stabilisation.

The bank will work to strengthen security and safety in online banking transactions to assure the legitimate rights of the customers, he added./.