Hanoi (VNA) – The average tax incentive for each major enterprise is currently tens of times higher than that for other groups of businesses in the economy, said an expert of the Vietnam Institute for Economic and Policy Research (VEPR).

Large firms are now accounting for the majority of the 64 trillion VND (2.76 billion USD) in tax incentives, leading to the fact that the tax paid by them is even lower than that of micro-enterprises, according to a report the VEPR released at the Vietnam Fiscal Policy and Development Forum in Hanoi on November 13.

The report pointed out that in 2016, the State budget’s tax expenditures were 86 trillion VND, rising by 40 percent from 2014 and 50 percent from 2012. It included 64 trillion VND in tax reduction, almost doubling the figure in 2012, 34 trillion VND.

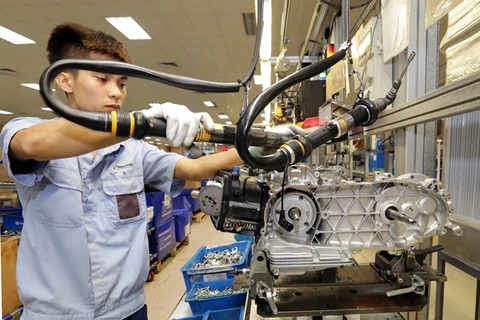

Notably, tax expenditures mainly come from tax incentives and concentrate on big businesses engaging in industrial activities or belonging to foreign invested companies based in industrial parks.

[Firms encouraged to make integrity pledge to improve business climate]

VEPR Director Nguyen Duc Thanh said the corporate income tax incentive in 2016 was equivalent to 7 percent of the total State budget revenue, 30 percent of the corporate income tax and almost 5 percent of the total budget spending, and it is always higher than the budget spending on health care.

He noted the average tax incentive for each large enterprise is currently tens of times higher than that for other groups of businesses in the economy.

Besides, foreign invested businesses still benefit from more tax incentives when the tax rate on them is always lower than that imposed on other groups in the economy.

Average tax expenditures for each enterprise in industrial parks are at least 30 times higher than those for other economic sectors. The actual tax rate on them is only some 10 percent, roughly half of the general tax rate.

The fiscal policy and development forum on November 13 is themed “Towards a fair tax system” (Photo: VietnamPlus)

The fiscal policy and development forum on November 13 is themed “Towards a fair tax system” (Photo: VietnamPlus) The forum pointed out that although Vietnam has posted impressive economic growth recently with a ten-year high GDP expansion of 7.1 percent last year and possible higher growth this year, its extraordinary economic track record has not been accompanied by a similar pathway in tax revenues.

Though tax incentive policies have contributed to the country’s economic growth, the conference thought it is time for Vietnam to rationalise such incentives for big companies as lowering corporate income tax rates and the existence of many tax incentives for foreign investors have decreased tax revenues.

Nguyen Thu Huong, Senior Governance Programme Manager at Oxfam Vietnam, stressed corporate income tax incentives in Vietnam have caused considerable fiscal costs and widened the income gap among social classes of people.

The reduction of corporate income tax incentives will help raise budget revenue by 20 percent while it will not negatively impact the macro-economy, she said, adding that the eradication of those incentives will only have negative influence on the firms with high income that mainly benefit from tax incentives.

“Enterprises that only arrive in Vietnam to enjoy tax incentives were not the outstanding ones. Outstanding enterprises want transparent tax policies for their investments, not just the incentives,” VEPR Director Thanh said.

However, the research team also warned that whether the removal of tax incentives will have positive or negative impact on the economy will largely depend on actions by the Government because if the Government uses the increased part in the budget to boost development investment or support the poor, social welfare will be improved and economic growth will be promoted. In contrast, that sum will not benefit economic growth if it is used for normal expenditure.

Oxfam’s tax policies expert Johan Langerock said the Vietnamese Government gives presents for foreign investors, who will not stay in Vietnam. So it is better to give such presents to local companies, especially small- and medium-sized enterprises (SMEs).

He added that certain incentives for local SMEs could help strengthen the economy in the long term as he believes local SMEs have big potential for development and will play an import role in the region in the future./.