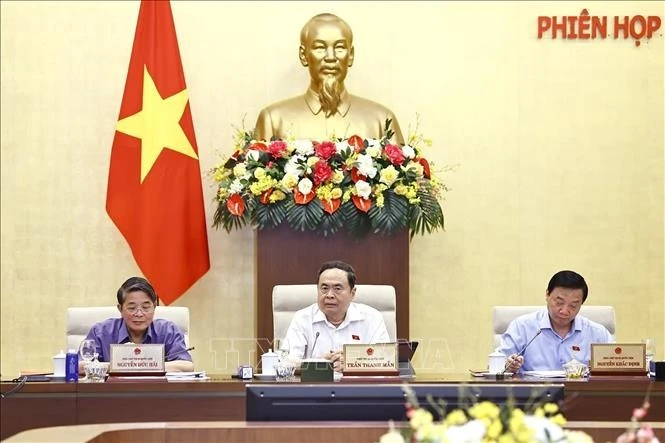

Hanoi (VNA) – The National Assembly (NA) Standing Committee discussed a draft resolution regarding the continued reduction of value-added tax (VAT) for the latter half of 2025 and entire 2026 at its 44th session on April 23.

Presenting the Government’s proposal, Deputy Minister of Finance Cao Anh Tuan emphasised the necessity of extending the VAT reduction policy to support economic recovery and development, encourage domestic consumption and tourism, and ease pressure on businesses and citizens alike.

The Government proposed a two-percentage-point reduction in VAT - from 10% to 8% - on goods and services currently subject to the 10% rate. This excludes certain sectors such as telecommunications, finance, banking, securities, insurance, real estate, metals, mineral products (excluding coal), and goods and services subject to special consumption tax (excluding petrol). The proposed timeframe for the reduction is from July 1, 2025 to December 31, 2026.

In terms of fiscal impact, Tuan stated that the VAT cut is expected to reduce state budget revenue by approximately 121.74 trillion VND over the proposed period, including around 39.54 trillion VND (1.52 billion USD) in the second half of 2025 and 82.2 trillion VND in 2026.

This policy will help reduce production costs as well as product and service prices, thereby stimulating business activity, boosting employment, and contributing to macroeconomic stability and economic growth in the second half of 2025 and the whole 2026.

For consumers and enterprises, the tax cut will directly reduce spending on goods and services and lower production costs, enhancing the competitiveness of Vietnamese products, he stated.

Delivering the verification report, Chairman of the NA’s Economic and Financial Committee Phan Van Mai noted that the majority of the committee's standing members supported the necessity of continuing the VAT reduction. They also agreed with the Government’s proposal to broaden the range of goods and services eligible for the reduced tax rate.

Some members suggested a thorough review of specific goods affected by global trade tensions and reciprocal tariffs, especially imposed by the US, to ensure Vietnamese enterprises in these sectors receive adequate support.

Others raised the possibility of further expanding the tax cut to include the remaining three excluded categories. They urged the Ministry of Finance to assess whether the revenue differential is substantial enough to justify the exclusion, recommending a more inclusive approach to ensure tax equity among all sectors and taxpayers.

At the session, Deputy Prime Minister Ho Duc Phoc said that the second half of 2025 will likely see continued pressure from US tariff policies. Therefore, extending the VAT reduction could help businesses stabilise operations and improve competitiveness.

He noted that Vietnam’s VAT rate is already lower than that of many other countries. The country has maintained a VAT rate of 8% - down from 10% - for the past four years, a measure seen as vital to helping enterprises recover post-pandemic.

In July, the drafting of the 2026 state budget and the medium-term financial and public debt plan for the next term will be made, providing a comprehensive forecast of fiscal capacity, Phoc said.

Concluding the discussion, Vice Chairman of the NA Nguyen Duc Hai confirmed the NA Standing Committee’s consensus with the Government’s proposal. He asked the Government to refine the draft resolution to enhance its persuasiveness before it is submitted to the NA for consideration at the legislature’s 9th session./.