Hanoi (VNA) - To date, the National Assembly's Resolution No. 42 on piloting the handling of bad debts has been implemented more than a third of the way. The results are quite clear, but there are still some obstacles that need to be solved for the resolution to become more efficient.

Internal bad debt ratio about to reach the target

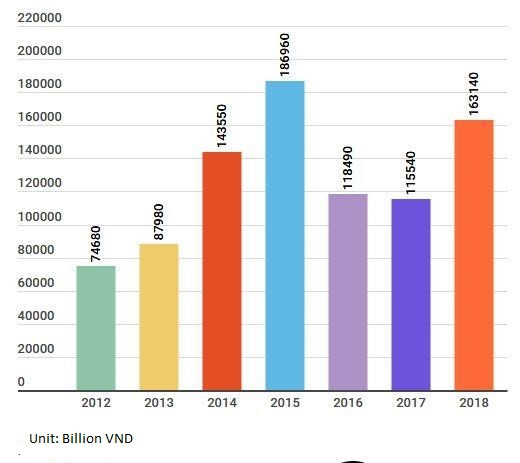

According to the report of the State Bank, from 2012 to the end of March 2019, the whole system of credit institutions handled 907.3 trillion VND of bad debt. Specifically, bad debt dealt with in 2012 was 74.68 trillion VND; 87.98 trillion VND in 2013 was; 143.55 trillion VND in 2014; 186.96 trillion VND in 2015; VND 118.49 trillion in 2016; and 115.54 trillion VND in 2017.

Particularly in 2018, the whole system of credit institutions handled 163.14 trillion VND of bad debt. The internal bad debt ratio by the end of March 2019 was 2.02%.

Besides, the internal bad debt ratio, debt sold to the Vietnam Asset Management Company (VAMC) has not been processed and implicit debts becoming bad debts of the credit institution system as of March 2019 was at 5.88%, down sharply from 10.08% at the end of 2016 and 7.36% at the end of 2017.

According to the State Bank of Vietnam, for Resolution 42, from August 15, 2017 to the end of March, the whole system of credit institutions handled a total of 227.86 trillion VND of bad debt, in which bad debt being handled reached 117.8 trillion VND.

VAMC leader also said that, for the purchase of debt with special bonds, from 2013 to March 2019, VAMC bought bad debt worth 338,849 billion VND of original balance sheet corresponding to the debt buying price of 307,567 billion VND.

From 2013 to March 2019, VAMC cooperated with credit institutions to reclaim debts estimated at 120,511 billion VND. Especially since Resolution 42 took effect, VAMC's debt recovery results in 2017 and 2018 were estimated at 67,891 billion VND, nearly 57% of the total value of accumulated debt recovery from 2013 to 2018.

The goal of the State Bank this year is to strive to bring the internal bad debt ratio to below 2% while strengthening inspection and supervision, strictly controlling the operation of credit institutions, supporting the restructuring of credit institutions associated with bad debt handling.

Many problems still remain

Dr Tran Du Lich, a financial and banking expert, said that currently there is a lack of a real market for buying and selling debt. Lich stated that in Article 5, Resolution 42 stipulates that credit institutions are allowed to sell bad debts and related collateral in accordance with the law and selling prices of the market. However, the sale of debts is still limited because credit institutions still mainly sell debts to VAMC and DATC (Vietnam Debt and Asset Trading Corporation).

In addition, the valuation of debts is being carried out by price assessing organizations, not according to uniform standards due to differences in assessing methods and criteria among assessing organizations. This makes it difficult for debt buyers and sellers to choose suitable reference prices for debt purchase and sale transactions.

Besides, according to the leader of the State Bank of Vietnam, there is a shortage of secondary markets and derivatives for debts. After purchasing the debt, the debt buyer performs the management, exploitation and operation of the collateral as well as the liquidity risk related to these secured assets. However, the transfer or mandate to manage these debts is difficult because there is no secondary debt market. Similarly, there are currently no derivative activities such as asset securitization, securities and bad debt securities. This leads to very low liquidity of debts, reducing the attractiveness of purchased debts./.