Hanoi (VNA) – The value added tax (VAT) will be reduced by 2 percentage points to 8 percent starting this February as part of measures helping taxpayers tackle difficulties.

The commodities and services currently subject to a VAT rate of 10 percent will benefit from the rate cut from February 1 through December 31, 2022, except for certain commodities and services, according to an urgent dispatch issued on January 28 by the General Department of Taxation.

Besides, businesses and organisations are allowed to include their spending on donation to or sponsorship of anti-COVID-19 activities this year in the expenses not subject to the corporate income tax.

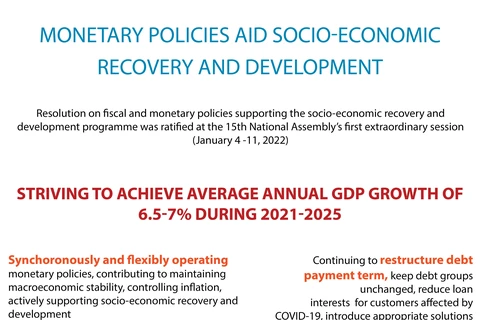

The urgent dispatch is to implement the Government’s Decree No. 15/2022/ND-CP, issued on January 28, which details the execution of the tax exemption and reduction policy. This policy is being carried out under the National Assembly’s Resolution No. 43/2022/QH15, released on January 11, on fiscal and monetary policies supporting the socio-economic recovery and development programme./.

The commodities and services currently subject to a VAT rate of 10 percent will benefit from the rate cut from February 1 through December 31, 2022, except for certain commodities and services, according to an urgent dispatch issued on January 28 by the General Department of Taxation.

Besides, businesses and organisations are allowed to include their spending on donation to or sponsorship of anti-COVID-19 activities this year in the expenses not subject to the corporate income tax.

The urgent dispatch is to implement the Government’s Decree No. 15/2022/ND-CP, issued on January 28, which details the execution of the tax exemption and reduction policy. This policy is being carried out under the National Assembly’s Resolution No. 43/2022/QH15, released on January 11, on fiscal and monetary policies supporting the socio-economic recovery and development programme./.

VNA