Hanoi (VNA) – Digital payments in Vietnam have continued to expand rapidly, with QR code transactions soaring by more than 150% in value, according to a report released by the State Bank of Vietnam (SBV) on October 29.

Internet and mobile payment channels also recorded robust growth, highlighting the strong presence of digital payments in both daily life and business activities.

Compared with the same period in 2024, total non-cash payment transactions across the system increased by 43.32% in volume and 24.23% in value, reflecting a strong shift from cash to electronic payments.

Internet transactions rose by 51.2% in volume and 37.17% in value, while mobile transactions climbed by 37.37% and 21.79%, respectively. Notably, QR code payments surged by 61.63% in volume and 150.67% in value, becoming the fastest-growing segment in the digital payment ecosystem.

Besides, interbank electronic payments posted steady growth, up 4.56% in volume and 46.87% in value, demonstrating the expanding transaction flow among commercial banks.

In contrast, ATM transactions fell by 16.77% in volume and 5.74% in value, showing a sharp decline in cash withdrawals as consumers increasingly turn to more convenient digital payment options.

As of the end of September 2025, the total number of Mobile Money accounts exceeded 10.89 million, with around 7.5 million belonging to users in rural, mountainous, island, and border areas, accounting for roughly 70% of all registered and active accounts.

More than 290.4 million transactions worth 8.51 trillion VND (over 323 million USD) were conducted through Mobile Money services, contributing to greater financial inclusion and narrowing the digital divide between urban and rural regions.

By late September, 53 organisations had been licensed by the SBV to provide payment services, including 49 offering e-wallets, reflecting a vibrant and diverse digital payment market.

According to the central bank, most basic banking services have now been digitalised, with many banks conducting up to 95% of their transactions through digital channels. The digital payment ecosystem continues to expand, integrating seamlessly with utilities, telecommunications, healthcare, education, e-commerce, tourism, and public administration services.

Customers can make payments, shop, pay fees, and book services directly via banking apps or e-wallets, saving time and costs while improving transaction safety and transparency.

Financial institutions are also accelerating the use of artificial intelligence (AI), machine learning, and big data to analyse customer behaviour, assess credit risk, personalise products, and automate operations.

Under the Prime Minister’s Decision No. 06/QD-TTg approving Project 06 on developing population data and national digital identity for the 2022–2025 period, with a vision to 2030, the banking sector has achieved significant results.

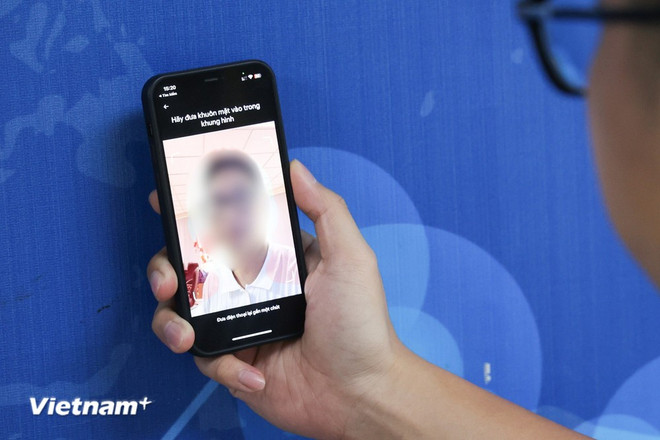

As of October 10, 2025, more than 132.4 million individual and 1.4 million organisational customer records had been verified through biometric data using chip-based ID cards or the VNeID application.

Fifty-seven banks and 39 payment intermediaries have implemented customer authentication via chip-based ID cards, while 32 banks and 15 intermediaries have adopted verification through VNeID, with 19 already in official operation.

Additionally, 28 banks and four intermediaries have linked social welfare accounts with bank accounts via the VNeID app, facilitating payments of allowances, pensions, and other benefits.

These outcomes demonstrate that Vietnam’s banking digital transformation is on the right track, playing a vital role in advancing the country’s digital economy and digital society./.