Hanoi (VNA) – FTSE Russell, a member of the London Stock Exchange Group, is set to announce the results of its review of Vietnam’s stock market status this September — a strategic step that can pave the way for significant inflows of international capital.

Vietnam’s stock market is now at a historic juncture when a highly antcipated strategic shift could reshape the country’s economic stature for decades. The upgrade goal — from frontier to emerging market — has been turned into a determined and coordinated action plan spanning from the Government to management agencies.

This is a prime opportunity to attract substantial international capital, improve market quality, and affirm Vietnam’s position as a transparent, sustainable, and potential investment destination on the global financial map.

The statement was made at a symposium on the upgrade of the stock market status and the expansion of capital mobilisation channels for the economy, which was jointly held by Lao Dong Newspaper and the Ministry of Finance on July 30.

Historic opportunity meets reform pressure

Upgrading the stock market status is a major policy of the Party and the State. The Politburo’s Resolution No. 68-NQ/TW on the development of the private economic sector clearly states that it is a must to promptly upgrade and restructure the stock market to improve quality and expand stable and low-cost capital mobilisation channels for the private economy.

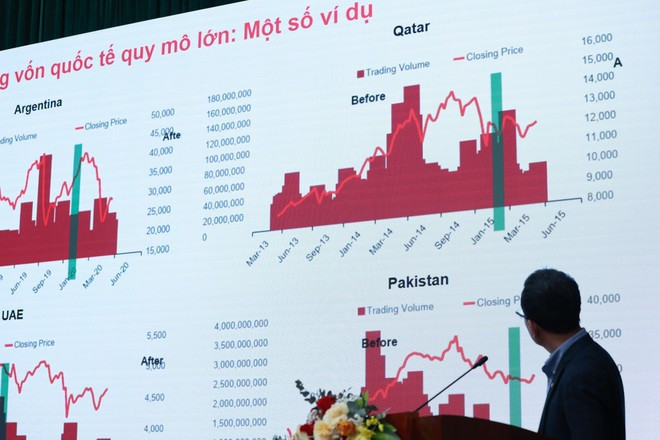

FTSE Russell is scheduled to announce the results of its review of Vietnam’s stock market status this September. If the market is upgraded, it represents strategic step that could help attract large-scale, stable, and long-term international investment flows.

Amid global volatility and strong geoeconomic shifts, Vietnam is emerging as a strategic bright spot. Experts at the seminar noted that the country is entering a pivotal phase in transforming its growth model and financial market.

Dr. Chu Tuan Linh from Hung Vuong University described Vietnam as being at a historic crossroads — a pivotal stage of development that unlocks resources from both the public and businessé. He said that this is time for reform – a rare period where historic opportunities and reform pressures converge.

According to Linh, the restructuring of global supply chains, coupled with a downward interest rate cycle, creates ideal conditions for international capital to flow into emerging markets with stable macroeconomic fundamentals like Vietnam. At the same time, trends in the digital revolution, green transition, and ESG (Environmental – Social – Governance) standards have become mandatory requirements, creating both pressure and motivation for Vietnam’s capital market to advance proactively and maintain its role as a key channel for funding the economy.

Decisive action

Seizing this chance, state management agencies — led by the Ministry of Finance and the State Securities Commission (SSC) — have implemented comprehensive and decisive measures to meet the upgrade criteria of international organisations, particularly FTSE Russell.

Detailing the roadmap, Pham Thi Thuy Linh, head of the SSC’s Securities Market Development Department, affirmed the regulator’s determination, saying that in line with the market upgrade goal stated in the Prime Minister’s Decision No. 1726/QD-TTg, the SSC has been urgently reviewing and proposing amendments to legal documents to gradually remove bottlenecks in the upgrade process.

FTSE Russell’s September review will release official assessments, she noted, adding that a positive outcome could see Vietnam added to the list of secondary emerging markets.

“As of now, from a legal standpoint, the Ministry of Finance has issued solutions to fully meet all the nine criteria set by FTSE Russell. However, positive experiences and feedback from foreign investors remain an important factor,” she emphasised.

To achieve the goal, the SSC is focusing on key measures, particularly removing the cap on foreign ownership. A draft amendment to Decree 155/2020/ND-CP is being submitted to the Government, aiming to make foreign ownership information more transparent and simplify procedures for enterprises.

Linh said the SSC will continue working with ministries and agencies to review and reduce the business sectors subject to foreign ownership limits, while encouraging enterprises to streamline their registered business lines to expand “room” for foreign investors.

Regarding the implementation of the central counterparty clearing (CCP) mechanism, Linh emphasised that it is a key element for a modern market. The legal framework and technical infrastructure on the KRX system are largely ready, she said, adding that the SSC announced a detailed roadmap for the CCP implementation from early 2027 and is quickly finalising related regulations.

In addition, the official stated that the SSC is working closely with the State Bank of Vietnam to amend regulations on opening and using payment accounts, aiming to simplify procedures and make it even easier for foreign investors to join the market.

In the coming time, the SSC will focus on developing new products such as green bonds and ESG-aligned instruments, promoting equitisation and State capital divestment, and linking IPOs with listings to attract enterprises. It will bring FDI-backed firms to the stock market, and consider launching new markets such as carbon credit exchanges and a capital market for startups, Linh said.

One of the most important milestones that lays a solid foundation for the market upgrade is the launch of the KRX IT system. This is not just a technical upgrade but a comprehensive infrastructure transformation, enabling the rollout of new products and services in line with international standards.

Nguyen Son, Chairman of the Board of Members of the Vietnam Securities Depository and Clearing Corporation (VSDC), said the KRX system was put into official operation on May 5, 2025. After nearly three months of operation, it has shown stable performance with no major errors impacting the market.

This is a crucial initial success, setting the precondition for the VSDC and the two stock exchanges to continue developing and launching new products and services integrated into the KRX system, Son said.

In addition, he affirmed that the stable operation of KRX will serve as the cornerstone for implementing the CCP mechanism (for the underlying market) as well as modern trading practices, such as same-day settlement (T+0) and covered short-selling, meeting the stringent requirements of international rating agencies./.