Hanoi (VNA) – Banknotes, which go from people to people, are a high-risk source of spreading virus. The habit of using cash among 90 percent of the population makes the banknotes, regardless of their materials as paper or polymer, a potential harmful factor to public health, which can transmit not only corona virus but many other diseases.

Infectious disease risks from banknotes

Viruses are present anywhere, but banknotes seem to be the last thing that people pay attention to, even though they all know that they are handed over from one to each other and contain large amount of viruses.

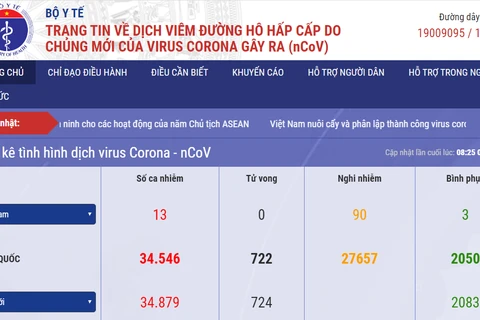

Amidst the complicated development of the disease caused by the novel coronavirus (2019-nCoV), as part of efforts to minimize the risk of infection, the State Bank of Vietnam (SBV) has directed commercial banks to put newly-produced banknotes into use, while temporary storing the old notes in an isolated place.

According to SBV leaders, the ratio of cash transactions is still large in Vietnam, but the bank has yet to have enough means to sterilise cash, while this can cause delay and disruption in transaction.

At a meeting with 21 commercial banks to seek solutions to remove difficulties for customers affected by the nCoV epidemic, SBV Deputy Governor Dao Minh Tu directed the whole banking system to ensure normal operation and non-stop services to people and enterprises.

He assigned the Department of Payment to design policies to loosen the online payment limit for both individual and business customers. He advised the public to miminise the use of cash and increase online payment to prevent nCoV spreading.

A representative from the National Institute of Hygiene And Epidemiology said that although there has been no official research on the risk of virus spreading through cash, people should be careful as some researches reveal that a banknote is home to about 3,000 different kinds of virus.

Online payment hoped to prevent virus

Ninh Thi Lan Phuong, Deputy General Director of Saigon-Hanoi Bank (SHB) said that the bank sees a chance to increase cashless payment as well as online saving. Many banks have also reduced fees for online money transfer, online banking services and other online services.

Some have encouraged their customers to conduct all transactions online during the current period. Nam A Bank has asked its staff to introduce and guide customers to use online banking services, while An Binh Bank advised its customers to switch to online transactions to minimize contact with disease vectors.

Momo, an online wallet app, also recommends the use of e-payment methods and channels to prevent nCoV spreading.

Another payment solution that is becoming more popular is contactless payment, which allowed users to pay their bills without having to give their cards to others.

So far, diverse cashless payment methods have been popularized, especially in major cities like Hanoi and Ho Chi Minh City, such as e-wallet or digital banks. E-wallet can be used to for money transfer, or pay for a wide range of services such as utilities, online shopping, air ticket purchase, insurance premiums, and pay at restaurants, supermarkets, hospitals and small shops. Promoting the use of cashless payment is not only a policy of the Government but also a trend and a good tool to control corruption, tax evasion and money laundering.

Leaders of the SBV affirmed the consistent policy to increase cashless payment.

Pham Tien Dung, head of the SBV Department of Payment, said that as of the end of November 2019, over 146 million transactions totaling 87.591 quadrillion VND (3.76 billion USD) were made on the inter-bank e-payment system, up 17.77 percent in the number of transaction and 32.49 percent in value compared to the same time in 2018. However, this is still a modest number in comparison to the total amount of cash transactions in Vietnam.

Despite the unconfirmed concern about the risk from cash use, some scientists have advised people to switch to digital payment, thus making full use of benefit from e-commerce instead of using cash amidst the outbreak of nCoV./.