Hanoi (VNA) - Vietnam is rapidly emerging as a promising financial investment hub, capturing growing interest from international investors. However, to transform its potential into reality, experts say the country must meet rising expectations in legal frameworks, infrastructure, and service quality.

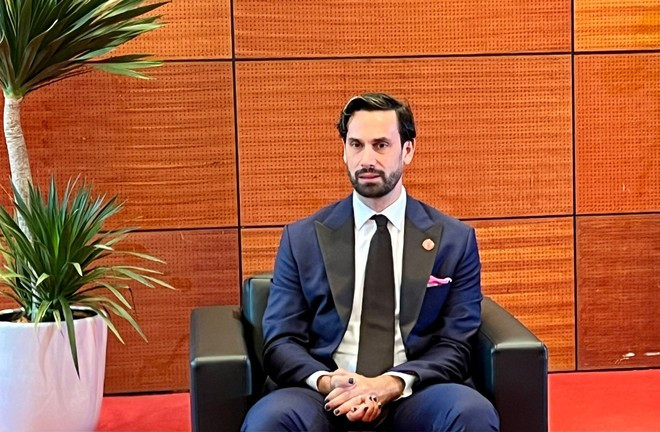

Vietnam has no shortage of the fundamentals needed to become an attractive investment destination, said Vinnie Lauria, Founding Partner of Golden Gate Ventures, a venture capital firm with over a decade of experience in Vietnam.

Lauria praised Vietnam’s business environment and described the market as “exciting,” attributing much of its appeal to the country’s human capital—characterised by high levels of education, talent, and ambition to build large and innovative enterprises. To date, Golden Gate Ventures has made nearly 20 investments in Vietnam and plans to accelerate this pace, aiming for the country to represent one-third of its new investments.

He also highlighted the dynamism of Vietnam’s startup community, particularly the large number of young entrepreneurs and the increasing participation of women, as a major positive factor.

The robust development of Vietnam’s entrepreneurial ecosystem will continue to draw international investors, Lauria noted.

To become a competitive financial hub in the region, investors expect Vietnam to enhance three key areas: regulatory environment, infrastructure, and service quality.

On regulatory reform, Lauria emphasised the need to facilitate cross-border transactions. He suggested allowing Vietnamese entrepreneurs to hold shares in foreign companies to simplify capital mobilisation.

Chad Ovel, a representative of Mekong Capital — which has invested in Vietnam for 25 years—echoed this view. He highlighted the need to streamline procedures to enable easier access for foreign investors, particularly in smaller-scale startup investments.

While acknowledging Vietnam’s progress in infrastructure development, Ovel noted room for improvement, especially in transportation, telecommunications, and energy.

Regarding service quality, Ovel praised Vietnam’s high-caliber workforce in innovation and digital transformation but stressed the need for a more vibrant financial market. He proposed establishing a dedicated stock exchange for startups and tech companies.

Despite the opportunities, investors were candid about the challenges Vietnam must address to attract more capital. One key concern is the trend of Vietnamese startups registering overseas.

Ovel explained that some tech companies opt to incorporate in Singapore due to its simplified processes for raising venture capital, whereas registering foreign investment in Vietnam often involves lengthy and complex procedures.

He urged Vietnam to continue supporting the education system, celebrate entrepreneurial success, and help Vietnamese companies expand globally. He also recommended the development of a regulatory “sandbox” to allow startups to trial new products and processes without burdensome approvals.

More Vietnamese unicorns expected

Hiren Krishnani, Southeast Asia Regional Director at Nasdaq, stressed the importance of building an effective corporate governance, recruiting the right board of directors, and clear storytelling to engage investors. He also encouraged Vietnamese companies to participate in more investment conferences in the US to build relationships and gather feedback.

Although no specific investment plans were revealed, investors expressed strong optimism about Vietnam’s market potential. Lauria said Golden Gate Ventures is exploring various sectors, including healthtech and edtech.

Krishnani affirmed Nasdaq’s full commitment to Vietnam and said he hopes to see more Vietnamese “unicorns” - startups valued at over 1 billion USD - listed on the Nasdaq in the future.

International experts agree that Vietnam holds key advantages in its dynamic, youthful workforce and growing government support. However, to become a truly competitive financial center in the region, the country must further strengthen its legal framework, infrastructure, and service standards.

Resolving these challenges, experts say, will be a critical “push factor” for Vietnam to realise its ambition of becoming a leading regional financial hub—one that attracts capital, fosters innovation, and drives sustainable economic growth./.