Hanoi (VNA) - Vietnam is set to introduce appropriate policies and measures to effectively respond to the United States’ new tax regime, with a focus on further improving the investment climate and facilitating business operations.

In the context of global economic volatility, particularly shifts in international trade policy, Vietnam faces both challenges and opportunities.

The recent announcement by the US of a reciprocal tax order, imposing a 20% levy on Vietnamese goods, has drawn strong attention from the public and the business community.

Nguyen Thi Huong, Director-General of the National Statistics Office (NSO) said the 20% tariff, effective from August 7, would inevitably affect Vietnam’s import-export performance and foreign direct investment (FDI) inflows. The NSO has made preliminary assessments for both the short and long term.

In the short term, as the tariff applies to all exporting countries, Vietnam’s competitive position in the US market will not be disproportionately affected compared to others. However, it will increase costs and product prices.

Currently, the US is Vietnam’s largest export market, accounting for around 30% of total export value. In the first seven months of 2025, Vietnam’s exports to the US grew 27.8% year-on-year. With the 20% tax, this growth is expected to flatten in the remaining months. Particularly, the 12 key export groups to the US—making up 91.4% of total exports to the market—may see slower growth. These include computers and components, machinery and equipment, textiles, phones and components, wood and wood products, footwear, toys, sporting goods, plastics, vehicles and spare parts, handbags, hats and umbrellas, and seafood.

Nonetheless, Vietnam’s overall export growth for 2025 is still projected to remain strong, supported by effective use of free trade agreements (FTAs), maintaining traditional markets (the US, Europe, ASEAN) while diversifying into new, promising destinations (the Middle East, Latin America).

In the longer term, Vietnam will adopt measures to adapt effectively to the new US tax policy. Priorities include improving the investment environment, facilitating businesses, supporting domestic firms in diversifying export markets, boosting competitiveness, and promoting industries benefiting from zero tariffs under FTAs.

As of July 31, total registered foreign investment (new, adjusted, and capital contributions/share purchases) reached 24.09 billion USD, up 27.3% year-on-year.

Newly registered capital stood at 10.03 billion USD across 2,254 projects, up 15.2% in number but down 11.1% in value. Adjusted capital surged 95.3% to 9.99 billion USD from 920 projects, reflecting foreign investors’ confidence in expanding existing operations. Meanwhile, capital contributions and share purchases rose 61% to 4.07 billion USD.

Although the 20% US tariff is higher than some ASEAN peers, it remains lower than that of many countries worldwide. This presents both challenges and opportunities for Vietnam to filter and attract higher-quality FDI.

Despite global trade uncertainty, Vietnam retains strong appeal thanks to its improving business environment, flexible incentives for high-quality investment, competitive workforce, and favourable geographical location in regional supply chains.

Statistics show that agriculture, forestry, and fisheries maintained steady growth. Autumn-winter rice cultivation reached 313,400 hectares, up 20,800 hectares year-on-year. Poultry farming grew 3.9%, while forestry achieved positive results with newly planted forest area rising 15.1%. Aquaculture output totalled 3.18 million tonnes.

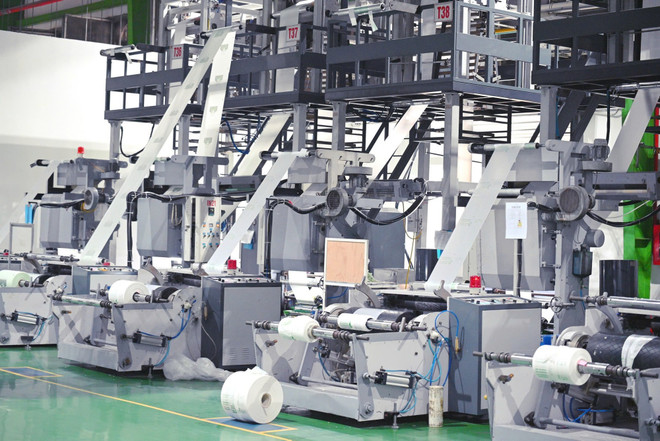

Industrial production also posted solid growth, with the Index of Industrial Production rising 8.6%, led by manufacturing and processing at 10.3%—the highest since 2020.

Trade, services and tourism saw strong recovery. Total retail sales and service revenue grew 9.3%. Passenger transport rose 21.5%, while cargo transport expanded 13.7%. Total import-export turnover hit 514.7 billion USD, up 16.3%, with a trade surplus of 10.18 billion USD.

Inflation remained under control, with the average consumer price index (CPI) up 3.26%, below the 4.12% increase in the same period of 2024. International arrivals reached 12.23 million, a 22.5% rise and the highest seven-month figure in years./.